There can be no doubt that e-commerce is on the rise, initially spurred on by people needing to stay at home, shopping online has become a way of living for many of us.

FNB Merchant Services data released in March indicates the local ecommerce market has grown significantly since 2019. According to FNB it is worth some R200 billion per annum, and expected to reach some R400bn by 2025. FNB’s data shows an overall increase in sales of 55% in 2020 and 42% in 2021.

“It is not surprising that we have seen such exponential growth in online retail, given that it was able to fill a need for goods and services that people could not go out and purchase because of lockdowns,” says Peach Payments Head of SME Growth & Marketing Joshua Shimkin.

World Wide Worx found that online retail has more than doubled in the past two years, as a result of the explosion in demand for home deliveries brought about by the Covid-19 pandemic.

Online Retail in South Africa 2021, a study conducted by World Wide Worx with the support of Mastercard, Standard Bank and Platinum Seed, showed that online retail in South Africa in 2020 grew by 66%, bringing the total value of online retail in South Africa to R30.2 billion.

Dirk Tolken, CXMO of e-Commerce development agency Semantica Digital is excited about the growth of e-commerce in South Africa.

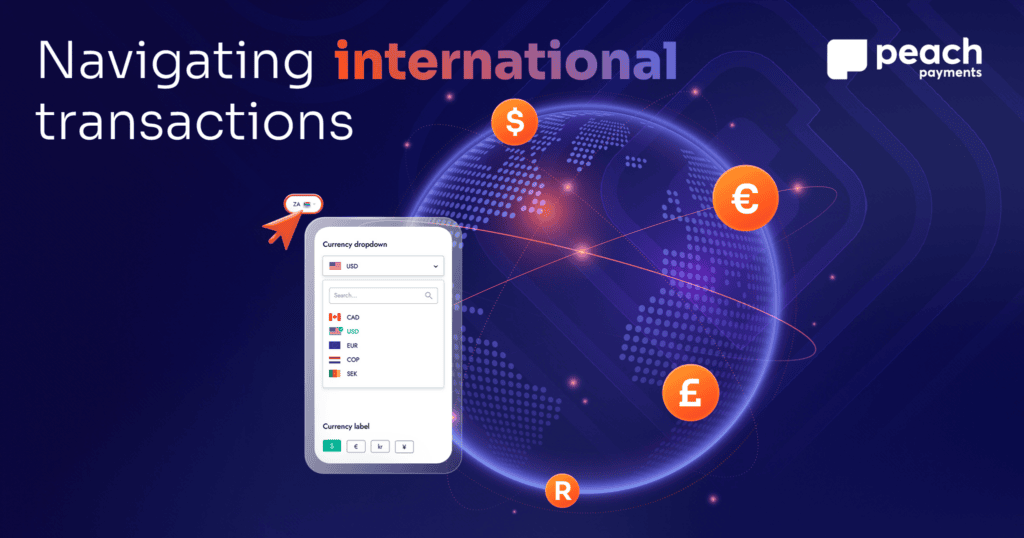

“In recent years we have noted extensive growth in online payments from non-traditional areas like online bookings for various niche sectors like online service delivery, and a rejuvenated travel sector since the end of 2021,” says Tolken. “It’s important for agencies to work with trusted payment partners, like Peach Payments, who are recognised in the market and understand the different applications of online payments in an ever-changing digital ecosystem.”

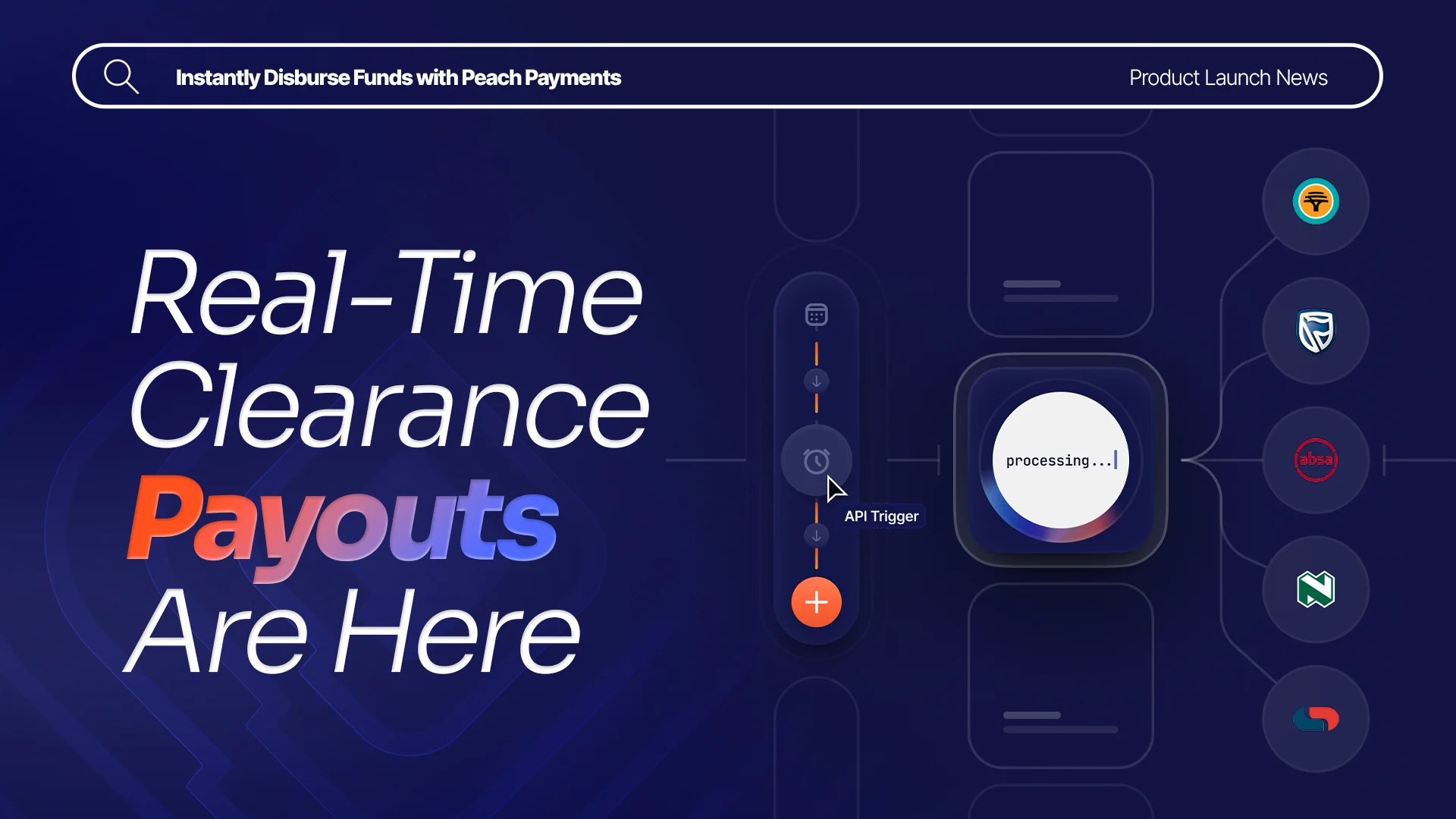

“As demand for online shopping drives supply and more and more people build websites to sell goods online, so too will there be a need for payment providers,” says Shimkin. “Choosing a payments partner, however, can be tricky, as you need to make certain that the solution you choose provides your business with the features and functionality you need.”

Here are five key things to consider before putting your business online:

- More people shop on their phones, so your service provider needs to have responsive widgets and native software development kits for iOS and Android to ensure you are mobile-ready.

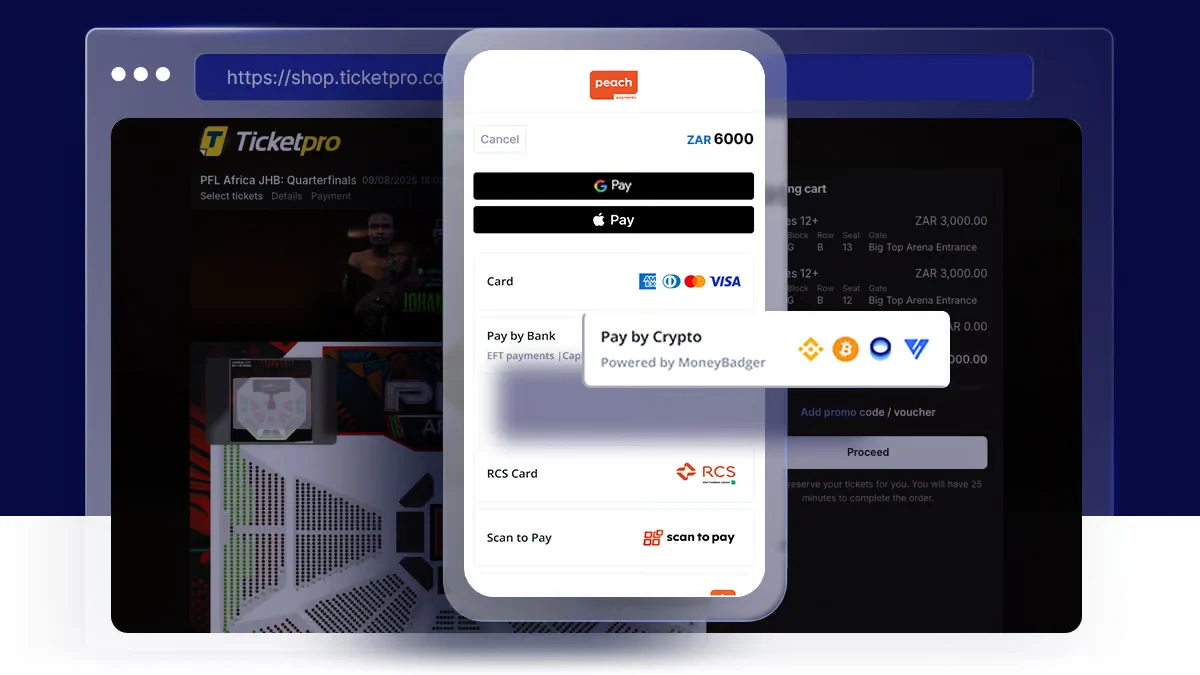

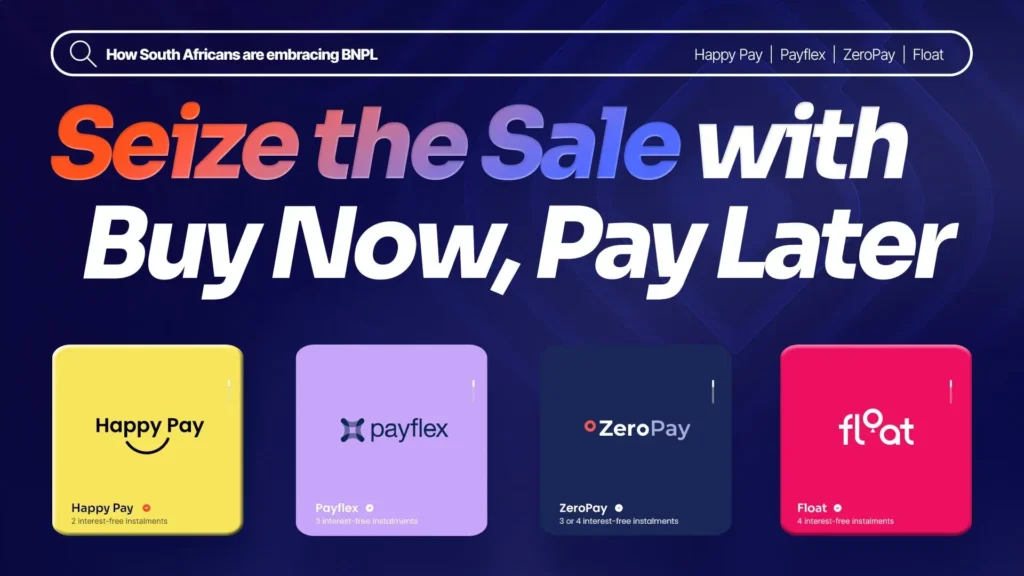

- Make sure you can take payments from all sources. Ever shopped online and only PayPal is available, and you can’t pay with EFT, a QR code, or any other solution that is convenient to you? The best payment providers can take a variety of payment types.

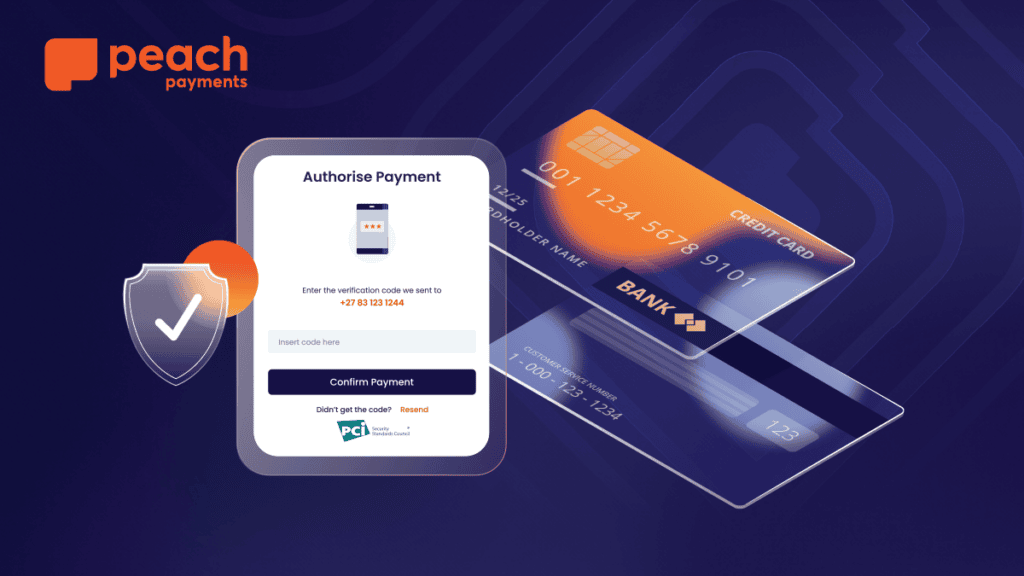

- Users should be able to shop on your site or app seamlessly. They don’t want to click numerous times to get through what seems like an endless number of pages to buy and pay. That can cost business, because they may get fed up and not finish the transaction.

- Customers may also get frustrated by having to enter card details numerous times. No-one remembers those, and this requires getting up from the couch, and entering 16 digits, and then double checking them. Rather choose a supplier that offers advanced one-click checkouts, Apple Pay, PayPal and subscription payments with a secure card storage feature.

- Pricing should be negotiable based on your sales volumes. Fees should be transparent and clear with no hidden fees and clearly defined settlement periods so that you can manage your cashflow easily.

“Do your research when choosing a payment provider to ensure they provide the right mix of useable technology, integrations, fees and transaction success rate to support your business today and into the future as you grow and scale,” Shimkin concludes.