Chargebacks aren’t simply refunds wrapped in admin. They’re a formal, bank-led reversal of a card payment after a customer disputes a transaction. If you sell online, you will encounter them. The real question is whether they nibble at your margins or snowball into a costly distraction. With a clear grasp of how chargebacks work (and a few practical habits), you can keep volumes low, win the winnable cases, and fix the root causes before they spread.

What is a Dispute?

A dispute occurs when a cardholder contacts their card-issuing bank to request a return of their funds. This mechanism is designed by card networks like Visa, Mastercard, and American Express to protect cardholders from fraudulent activities.

What is a Chargeback?

A chargeback is a subsequent action initiated by the issuing bank following a dispute. Once a customer contacts their bank to question a card payment, the bank investigates and, if the rules allow, takes the money back from your payment provider. This amount is then deducted from your merchant account, and a dispute case is opened.

You can either accept the chargeback or fight it by sending proof that the transaction was valid. For example, order details, delivery confirmation, refund policy, messages with the customer, or evidence that the payment was properly verified.

It’s worth noting what a chargeback isn’t. Not every payment type qualifies: scheme chargebacks apply to card transactions. EFTs and other rails follow different processes, even if customers sometimes use the same language to describe them.

Why disputes happen (and how patterns emerge)

Most disputes boil down to a handful of themes. Fraud or unauthorised use sits at one end; “goods not received”, “service not provided”, and “not as described” cluster in the middle; and processing errors (duplicates, wrong amounts, late presentments) round out the rest.

Card networks publish reason codes that map cleanly to these buckets. If you tag your cases internally by reason and by product or offer, patterns show up quickly. That’s where prevention becomes targeted rather than generic.

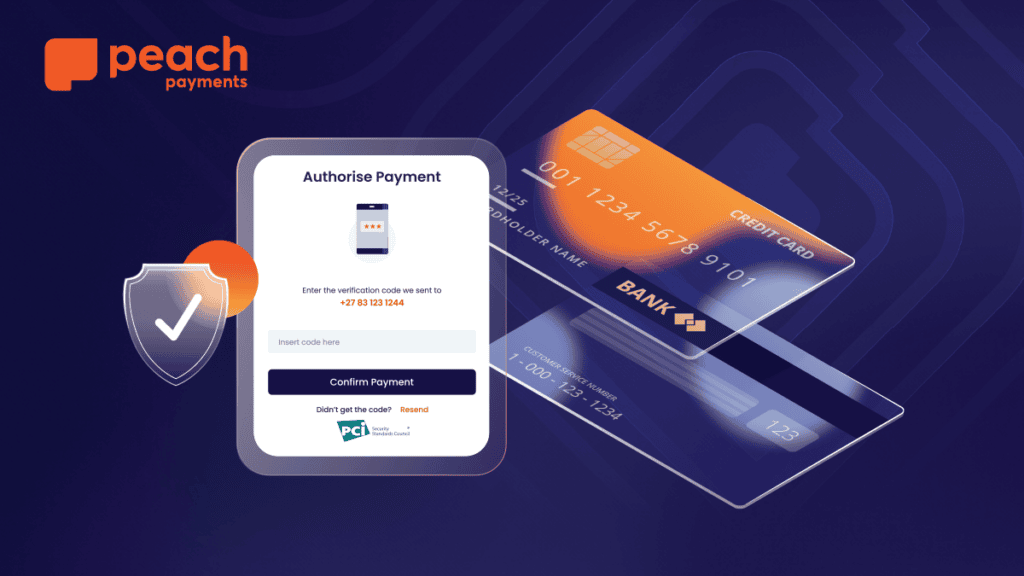

Most disputes happen because of fraud, when someone uses a card without permission. To help prevent this, Peach Payments uses 3D Secure. It’s a security step that asks the cardholder to confirm their identity (for example, by entering a code or approving a message on their phone) before the payment goes through.

The moving parts of chargebacks

Several parties touch a dispute: the cardholder, the issuer, the network, your acquirer, and you. Timeframes are strict and scheme-specific. The cardholder has up to 120 calendar days from the transaction date (or from the date goods/services were expected to be received) to raise a dispute with their issuing bank. Merchants have 7 days to respond once they are notified of a dispute.

Prevention beats cure

Most chargeback reduction has nothing to do with legalese and everything to do with clarity. Make sure your billing descriptor on statements is recognisable and matches what customers see at checkout and in emails. Set expectations sensibly: delivery timeframes, return terms, and any material product caveats should be easy to find and written in plain English. Confirm orders clearly and give customers a straightforward path to support. Many disputes begin as service issues that could have been solved in your help desk long before a bank got involved. Also make sure there is a way for customers to contact you and provide regular updates once a dispute is raised.

Authentication and processing hygiene matter just as much. Use 3D Secure for card-not-present transactions to strengthen authorisation. Keep a close eye on your own processing: duplicate captures, amount mismatches and late presentments are fully preventable, yet they generate a surprising share of disputes. Finally, if you store card credentials for returning customers, do it the right way—via tokenisation in a PCI DSS-compliant vault—not on your own servers. That reduces your PCI scope and removes a major source of risk.

Building an evidence pack that actually wins

Think of your dispute documentation as a template library rather than a scramble. For orders delivered physically, courier tracking, delivery confirmation and any signed/OTP proofs are essential. For digital products and services, usage logs, IP and device data, and clear time stamps do the heavy lifting. Always include the order and invoice trail, the version of your refund and returns policy in force at the time, and where the buyer agreed to it. Add your customer service correspondence to demonstrate your effort to resolve matters directly. The key is relevance: respond to the reason code, not to everything you wish were in scope.

Metrics that matter

Three numbers tell you whether you’re improving. The number of chargeback disputes shows whether chargebacks are trending up or down relative to transaction volume. Your win rate (successful resolution of chargebacks) shows whether evidence quality is moving in the right direction. And your internal time-to-respond (and within a deadline) shows whether you’re giving your acquirer the best chance to hit scheme deadlines. Layer on a simple view of the top reasons and the SKUs or offers most commonly involved, and you’ll know exactly where to focus next.

How Peach Payments helps

Peach Payments is designed to reduce both the likelihood and the impact of chargebacks. Sensitive card data never lives on your web servers; when shoppers choose to save a card, credentials are stored using tokenisation in our PCI DSS 4.x vault. 3D Secure is supported out of the box to strengthen authentication for card-not-present transactions. On the operational side, we’ll help you map each reason code to the evidence that matters and set up straightforward reporting so you can spot trends rather than firefight tickets. The goal is simple: fewer disputes, faster resolutions, and more time spent serving customers instead of compiling PDFs.

The takeaway

Chargebacks won’t disappear, but they can be managed. Set clear expectations with customers, authenticate well, keep your processing tight, store credentials safely, and respond quickly with relevant evidence when disputes arise. Do those consistently and chargebacks become a measurable cost of doing business – not a risk to your revenues or your reputation.

For more information on chargebacks, read more here.<\/p>