In the competitive world of floristry and gifting, staying relevant and visible online can be a daunting task. Especially for businesses who may lack the technical expertise or resources to establish their own digital presence.

Enter Bloomable, an innovative online marketplace that has effectively transformed the way florists and artisans do business. Originally launched as SA Florist, the platform aims to create a new sales channel for florists and gifting companies, enabling them to thrive in the digital age without the burden of developing and maintaining their own websites.

From its humble beginnings with a smaller network, today Bloomable has grown to support around 250 florists and artisans, offering them an online presence and a steady stream of customers. This approach has been especially beneficial for businesses who are not tech-savvy, allowing them to focus on their craft while Bloomable handles the complexities of online sales and marketing.

Meeting the Changing Needs of Customers

Bloomable has always placed customer experience at the heart of their business. To meet the demands of premium gifting and accommodate new product categories, they recently integrated with Shopify. This updated platform not only enhances their brand’s appearance but also supports its evolution without necessitating a full rebrand.

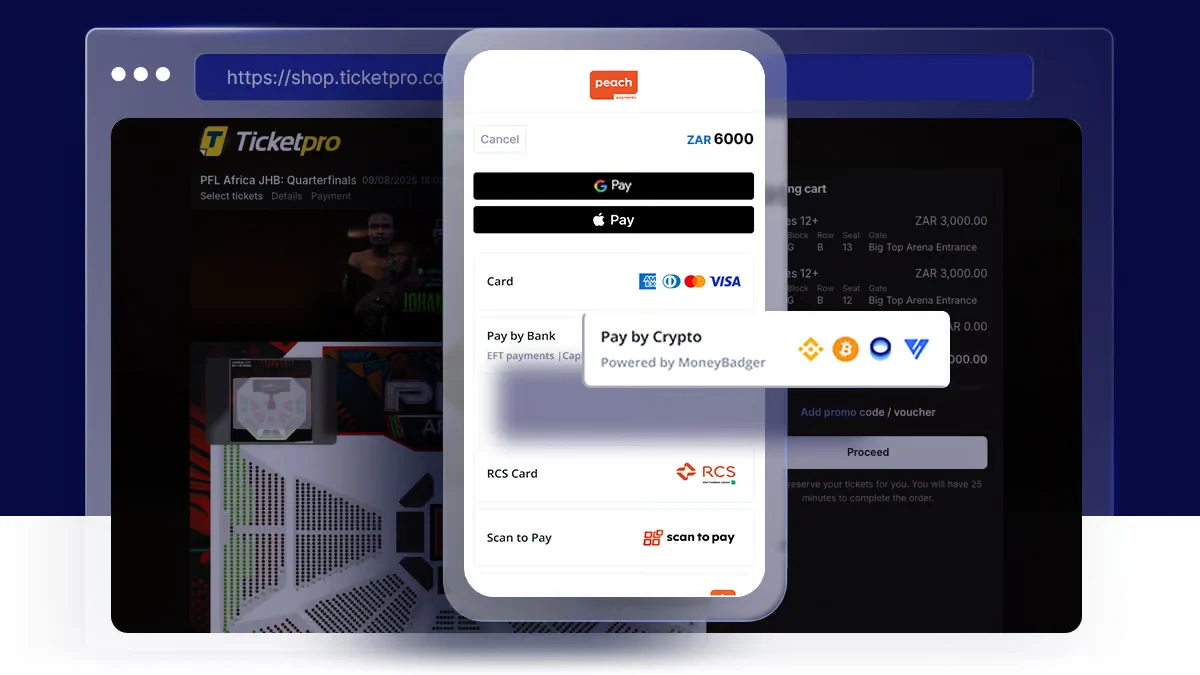

A key part of this journey has been the adoption of new payment methods, aligning with customer preferences and improving the overall shopping experience. Shopify’s global service, however, lacked a comprehensive payment gateway for all regions, making Peach Payments a crucial partner in bridging this gap.

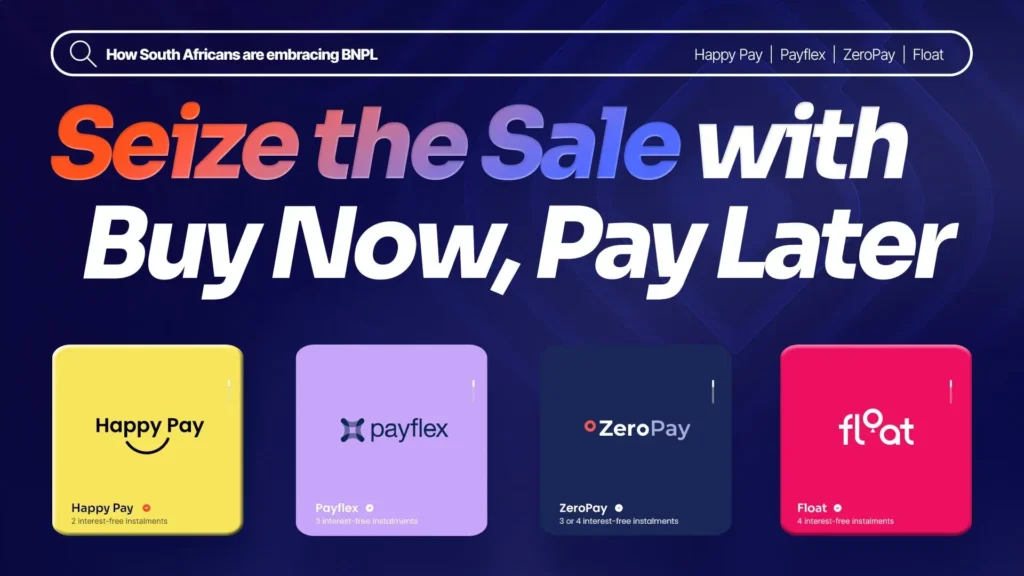

Peach Payments enabled Bloomable to offer a variety of payment methods, including Pay by Bank, which reduced fraud risk and sped up order processing. Additionally, the inclusion of Buy Now, Pay Later options has grown in popularity, leading to increased orders for Bloomable. This flexibility and innovation in payment solutions have been instrumental in Bloomable’s ability to adapt and thrive in the digital marketplace.

“Peach Payments offers a variety of payment methods that have significantly reduced friction for us. Their solutions have enabled us to offer same-day delivery, overcoming previous challenges caused by payment delays.”

Introducing flagship subscription services

Bloomable’s innovative drive led them to launch their flagship subscription services, marking a significant pivot in their business model. Once again, Peach Payments emerged as the ideal partner. By integrating with Subscription Flow through Peach Payments, Bloomable was able to implement subscription payments seamlessly. Without Peach Payments, Bloomable would have faced the daunting task of coding the subscription service from scratch, which would have been both costly and time-consuming.

The support and integration capabilities of Peach Payments enabled Bloomable to quickly get their subscription service up and running. This swift implementation allowed Bloomable to capitalize on the growing demand for subscription-based products, particularly in the post-pandemic market.

Subscriptions have become a significant growth area for Bloomable, with a notable increase in demand. This new revenue stream has helped stabilize and grow the business, allowing them to better serve their customers and expand their offerings

“Peach Payments really opened the gates for us. If it wasn’t for your willingness to get involved, we probably still wouldn’t be live with subscriptions. It would have been an absolute nightmare and very costly to code that all from scratch.”

Smooth checkout and improved conversion rates

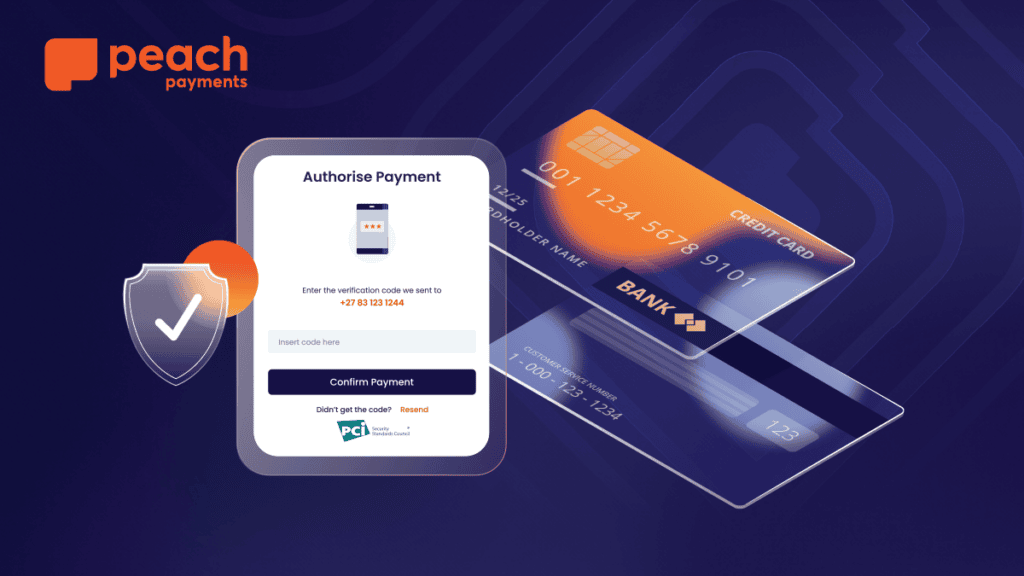

Bloomable has also seen a remarkable improvement in their conversion rates since integrating Peach Payments.The seamless checkout experience provided by Peach Payments has been a significant factor in reducing friction for customers, leading to higher conversion rates.

This improvement is a testament to the effectiveness of Peach Payments’ technology in creating a smooth and efficient transaction process. By offering a variety of payment methods and ensuring quick and secure transactions, Peach Payments has played a crucial role in enhancing the overall shopping experience for Bloomable’s customers, directly contributing to increased sales and customer satisfaction.

“Our conversion rate on the site is probably the strongest I’ve ever seen on a website, and I attribute that to how good and frictionless the Peach Payments checkout process is.”

Next Steps for Bloomable

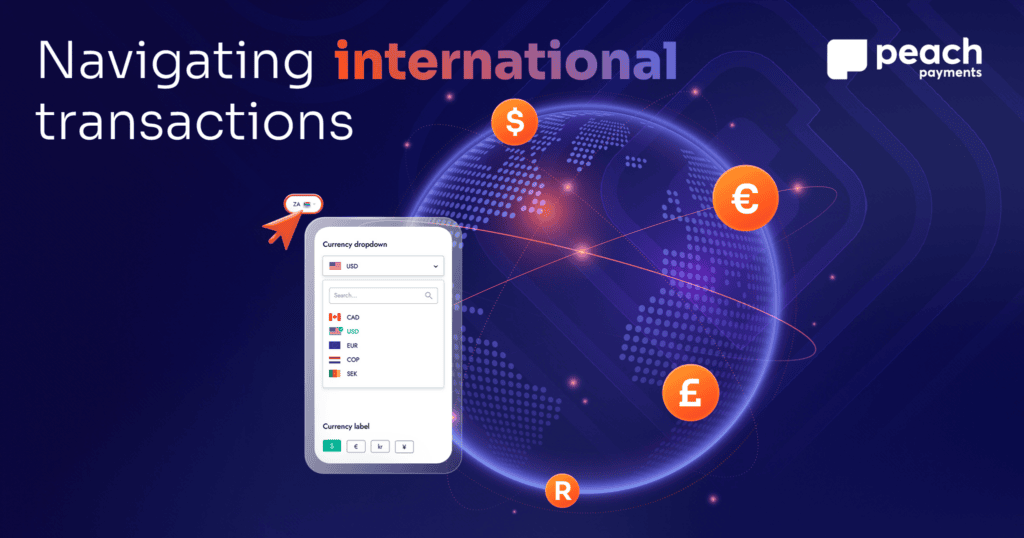

In coming years,Bloomable aims to scale their operations and expand into new markets. They plan to move into other countries, initially focusing on sub-Saharan Africa. This strategic expansion will allow Bloomable to ensure that all processes work perfectly before targeting larger markets.

The integration with Peach Payments and Shopify will facilitate this expansion, as these platforms support multi-currency transactions and provide the necessary technological infrastructure.

In addition to geographic expansion, Bloomable plans to diversify their product offerings by bringing on new artisans and expanding beyond gift boxes and flowers. This move aligns with their goal to become synonymous with premium gifting..

Peach Payments has played a vital role in Bloomable’s growth and success as a digital marketplace for florists. Their integration capabilities, innovative solutions, flexible payment options, and strong local support made them the perfect partner for Bloomable, enabling the business to expand its offerings, improve customer experience, and maintain operational efficiency.

Please visit https://bloomable.co.za