Unless you’ve been hiding under a rock, there’s no way you’ve missed the phrase scale your business. Seems simple enough: just grow your business. If you’re not failing, you’re growing, right? Like all things in life, scaling your business isn’t as black and white as that, and likewise, it doesn’t come easy.

Scaling is more about preparing for what’s to come rather than dealing with what’s happening now. Few small businesses are ready to scale right from the get go because growing seems like something to deal with once they’re already successful. When the goal is to solve the immediate problem of keeping expenses down and profit up, it’s difficult to think with the future in mind. But you can’t only start preparing for high sales volumes when they suddenly arrive or you’ll find yourself failing whilst you scramble to start scaling. So then the question comes down to: are you ready to scale?

What is scaling, and how do I start?

In a couple of words, scaling is growing efficiently. That growth takes many forms. What you’re aiming to achieve is increasing your revenue before the cost of running your business starts catching up with it. It begins with a growth in sales and customers, but it follows with the necessary technology, staff and services to match.

Imagine this scenario: one day you wake up to find ten times your usual orders on your ecommerce website waiting to be fulfilled. Until now, you’ve manually ordered couriers because it seemed like the easiest way to handle things. Your inbox is filling up with customers asking for confirmation of delivery, or even confirmation that you’ve received their payment because up until now, you’ve handled payments with a simple EFT system.

Every minute that goes by, your customers are losing faith in your brand and you’re also coming to the unfortunate realization that both your cost of delivery and the fees on each of your transactions are eating away at your profit. You never bothered to stipulate your return policy and you now have to consider what costs will be involved in getting your product back to you if your customers aren’t happy with it.

This is what failing to scale looks like. Success can be exponential and your ecommerce business can boom and crash over the course of a very tight time frame. So scaling is all about being ready for that boom and ensuring that you ride that exponential growth into a runaway success.

This means:

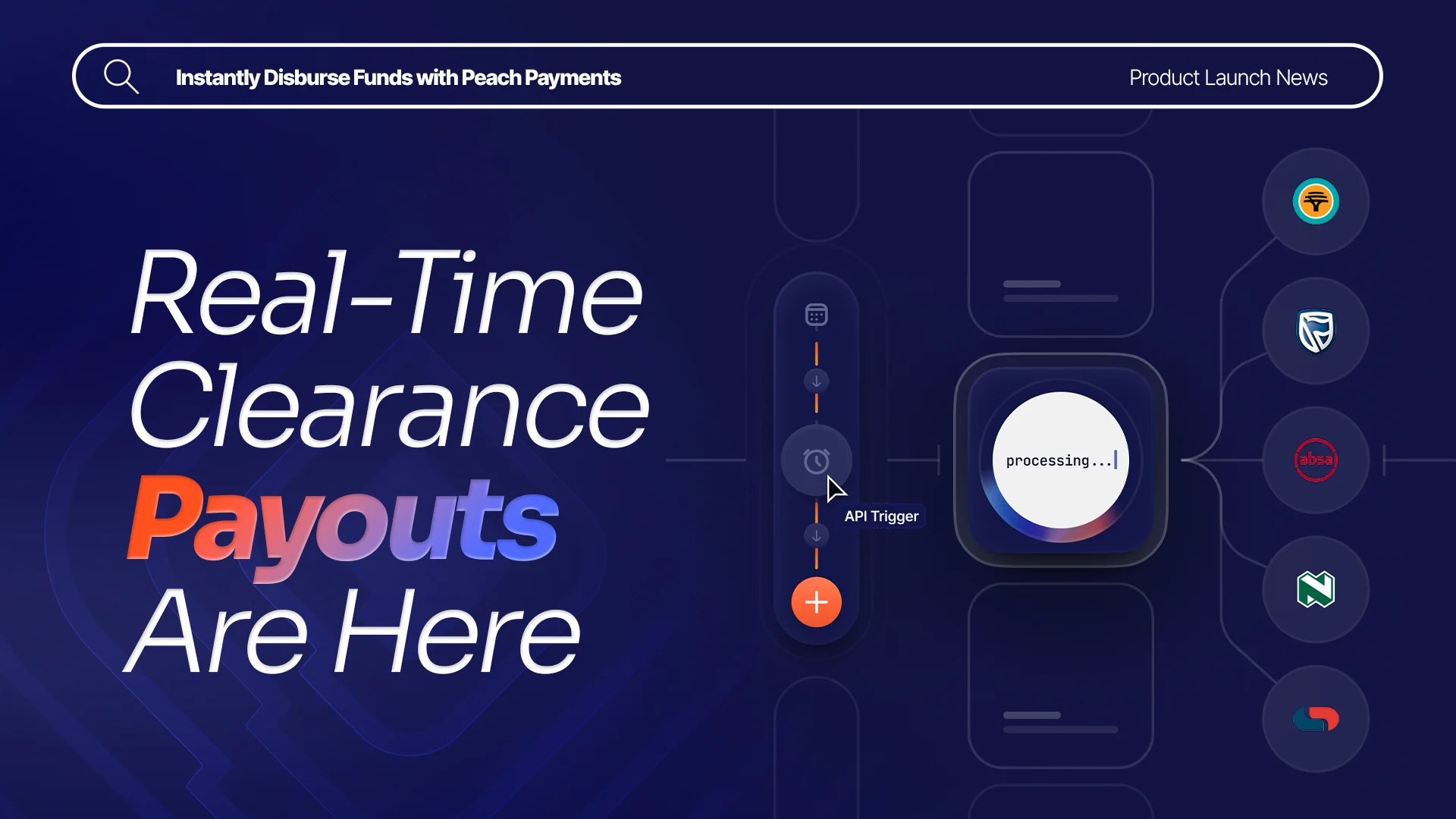

- Your payment gateway has industry leading support, and competitive transaction fees that can be negotiated based on your volumes

- You’ve arranged a relationship with a courier service that gives you the best price on delivery your product

- Your online store is monitoring and reflecting accurate stock counts and you know how to quickly replenish

- Your customer support system is in place and as automated as possible so that customers don’t lose faith in your ability to serve them

- You understand the services running your business so that if anything goes down, you’re able to contact the right people to get things up and running again

Every ecommerce business will have its own nuances to scale effectively and it becomes your job to understand exactly what your business will need when high sales volumes come rolling in.

What do scaling challenges look like, and how are they overcome?

Peach Payments client, Rentoza, experienced an unprecedented explosion in demand when COVID19 lockdown hit. Rentoza has a unique business model where they allow customers to subscribe to electronics and appliances with flexibility in the length of the subscription from 6 to 12 months depending on the product. When their subscription is complete the product is returned, allowing the customer to renew their subscription with an upgraded product. Rentoza wants to reconstruct the way we think about our appliances in a way that lets customers always have the most up to date product.

They started with short term contracts but COVID19 changed the nature of the market. They were suddenly met with a high demand for their services for much longer periods of time, and they found themselves in need of an instantaneous scale up.

The logistics of delivering and retrieving goods at the suddenly expanded scale became a nightmare. They had to restructure and partner with new couriers to try and keep up with demand, which resulted in delays.

“We’re on Rentoza version 3.0,” says Rentoza CMO, Mishaan Ratan, due to their constant need to reassess their market and the infrastructure needed to meet its demands. “Things started to stabilize when we found key partners who shared the same vision of scale at pace with us and incorporated them into our business infrastructure.

Rentoza managed to keep their heads above water thanks to the quality of their service, despite being dunked a few times. Had they anticipated the sudden increase in demand for their services, it would have been an easier ride.

-min.jpg?width=5472&name=isaac-smith-AT77Q0Njnt0-unsplash%20(1)-min.jpg)

How do I know my business is likely to scale effectively?

Upgrading and replacing the technology that runs your business is a key factor. If your success means that you’ll have to replace your ecommerce infrastructure, you could be looking at serious downtime. That downtime can kill your business, whether it be missing opportunities for sales or your customers losing faith in your brand entirely.

Your existing infrastructure needs to grow organically alongside your sales numbers. But what does that actually look like? Partnering with Peach Payments is the perfect example.

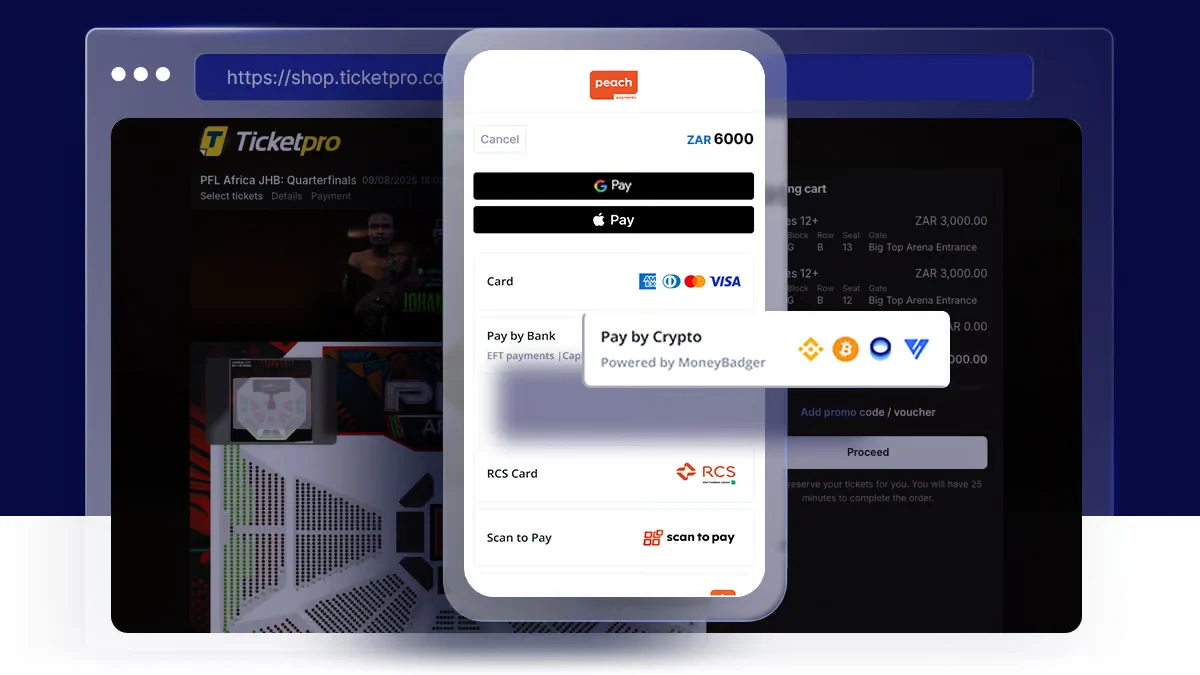

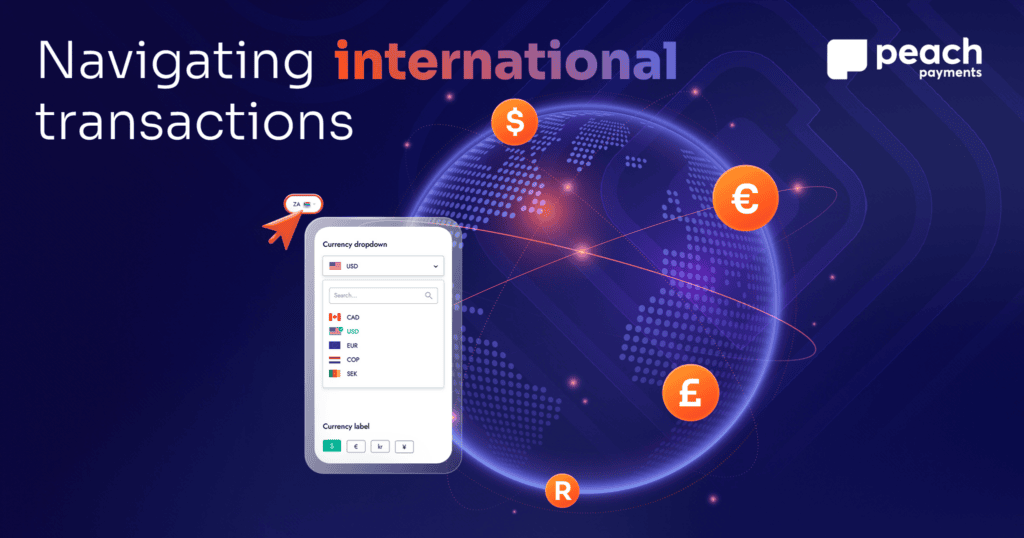

Peach Payments prides itself in supporting SMEs throughout their scaling journey, that’s why we encourage ecommerce entrepreneurs to #ScaleWithPeach. Peach Payments provides hands-on support whilst you’re getting your ecommerce business up and running and strives to maintain transparent and productive partnership throughout your growth. Pricing is structured around your sales so that fees don’t bog you down whilst you’re building up. Payment can be customized to your needs whether they be once off purchases, subscriptions, or international payments.

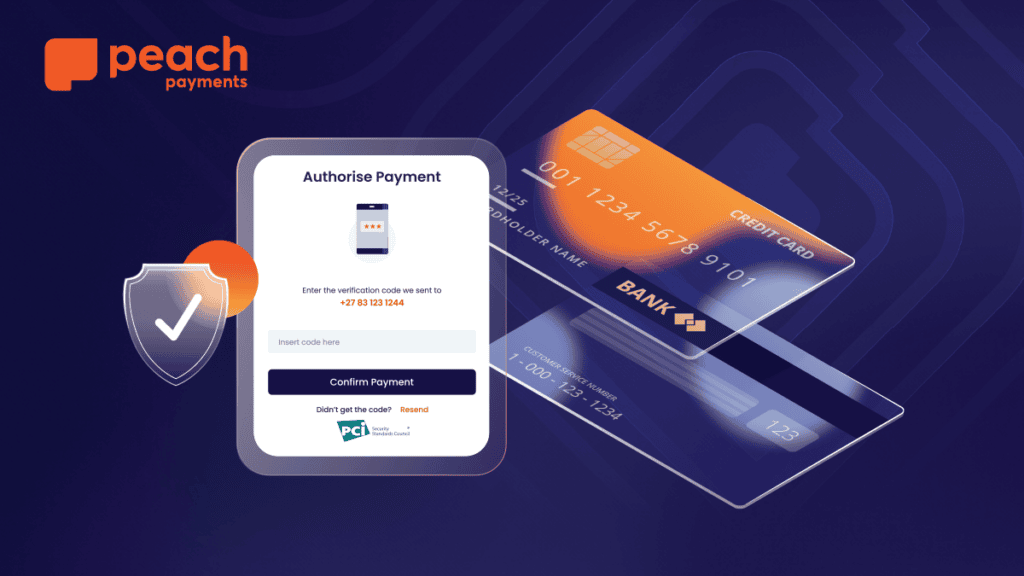

Most importantly, Peach Payments offers secure transactions, intuitive user experience, and is trusted by major ecommerce businesses, so that your customers feel safe when they make payments on your site. In the end, making sure that people are willing to come back for more will be the key to your scaling success, and Peach Payments is there to help you make it happen.