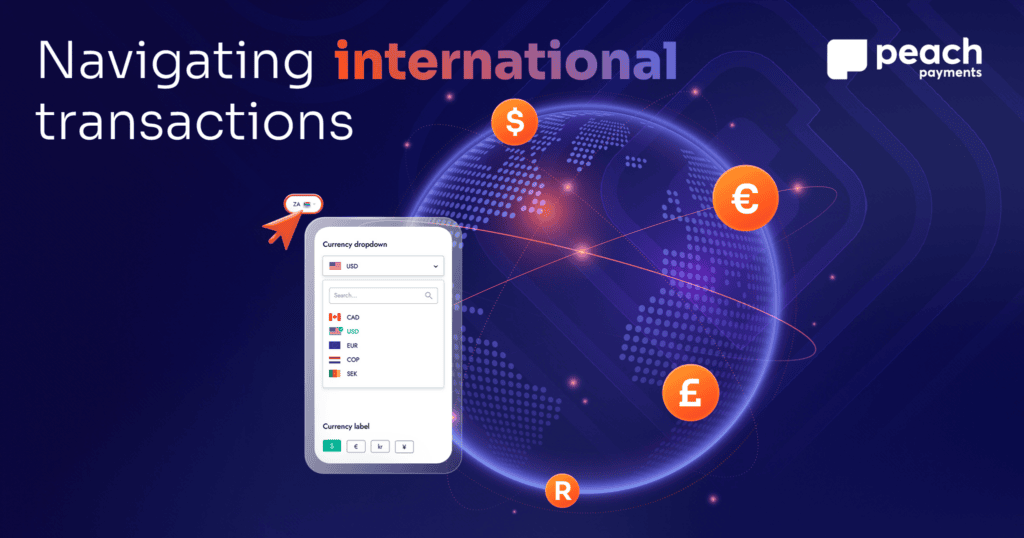

The World Economic Forum believes that as markets become increasingly digital, full SME recovery and success after the pandemic hinges on their ability to expand across borders. However, ecommerce business owners who want to sell to international customers have to keep several factors in mind.

“Adapting a business and brand to suit international markets, including offering payment options in different currencies, significantly increases the chances of an ecommerce business succeeding,” says Joshua Shimkin, Head of SME Growth and Marketing at South Africa-based online payment gateway Peach Payments.

As many as 50% of online consumers won’t buy a product or service if they can’t pay in their own currency. Most reputable payment gateways offer a foreign pricing option, but simply offering pricing in a foreign currency isn’t enough to ensure the product will be profitable for the retailer. The intricacies of the international banking system can affect the profitability of products, Shimkin warns.

“The customer may be charged in dollars, but the South African retailer is paid in rands, at a conversion rate that fluctuates daily and depends on the bank processing the transaction. On top of this fee, the retailer also has to pay the bank’s card acquisition fees on international purchases. Delivering a seamless online shopping experience may be both fraught and complicated for retailers, who need to meet high customer expectations,” he adds.

Below, he details four essentials online SMEs should consider when they add payment options in a variety of currencies to their sites.

1. Factor foreign currency conversion fees into your price – A foreign currency conversion fee of 5% might not seem like much, but SMEs have to account for 5% on every transaction, which adds up, Shimkin says. Some banks also levy additional forex charges, which may confuse the customer.

Online SMEs have the option of absorbing these fees as part of their business operating costs, but it is certainly not the only strategy for dealing with conversion fees. Some SMEs add the conversion costs as an additional fee at checkout but, Shimkin cautions, this is likely to result in abandoned shopping carts.

“Instead of surprising customers with an increased price at checkout, SMEs should factor the conversion fee into the displayed price, and alert their customers that bank fees may vary,” Shimkin says. “This helps to build customer trust and alleviates the burden of currency conversion fees on the SMEs bottom line.”

2. Expect varying margins due to constantly changing exchange rates – The vagaries of daily fluctuations in the actual conversion rates between currencies also need to be factored in.

“As a result, online SMEs’ margins may vary, depending on the exchange rates fluctuations at the exact time the transaction takes place, and should be factored into the SME’s planning,” says Shimkin.

Successful SMEs keep a close watch on daily movements in currency prices and adjust their own prices if necessary.

3. Don’t get – or pass on – nasty tax surprises – Value-added tax (VAT) is one of the most common taxes in the world and differs across the globe not only in its rate but also in which products are exempted.

“SMEs should be familiar with the VAT rules of each country they’re selling and shipping their products to,” Shimkin says.

In addition to VAT, there are several other taxes to consider, including import and export duties, which can vary widely and may even affect delivery times for customers if they are not paid timeously.

“It’s particularly important to make sure your customers don’t get a nasty surprise, so SMEs should include clear information about import and export duties on their sites,” Shimkin says.

He advises online SMEs to partner with reputable import/export specialists that can handle the import and export details for them, so they remain on the right side of both tax laws and consumer communication.

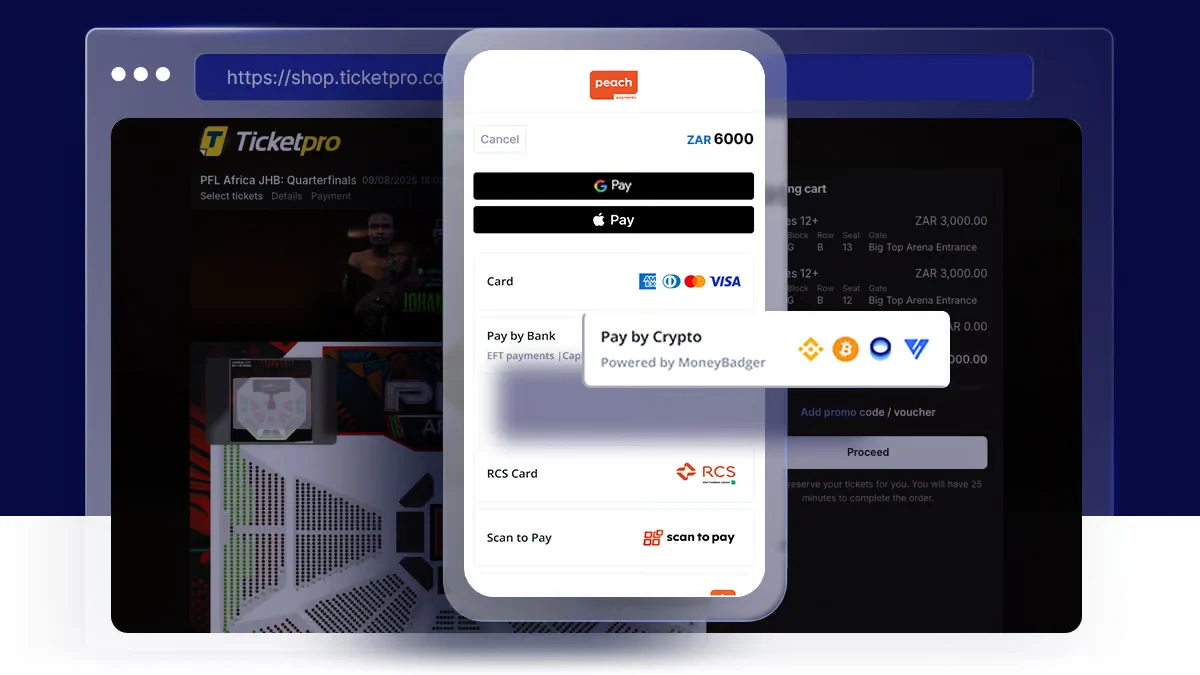

4. Keep in mind geographic preferences – Online SMEs should be aware that payment preferences differ across geographies, Shimkin says.

“Online consumers in the US, for example, prefer to pay with credit cards, while consumers in Europe prefer alternative payment options such as PayPal, and many South Africans prefer using debit cards and instant EFT payments. If you’ve done all the hard work to ensure that your product or service is available in a range of different currencies, you should also ensure that you provide your customers with the payment options they prefer,” he comments.

Similarly, consumers in some geographies prefer standard mail deliveries, while couriers are a necessity in other countries.

Despite these challenges, the potential benefits of international expansion for SMEs remain substantial, Shimkin concludes.