Our 2024 ‘Think Bigger’ Summit showcased the latest solutions from Peach Payments. With Black Friday just around the corner, it’s the perfect moment to reflect on some of these innovations, underscoring our commitment to staying ahead of industry trends and delivering on merchant needs.

Understanding the Importance of Payment Security

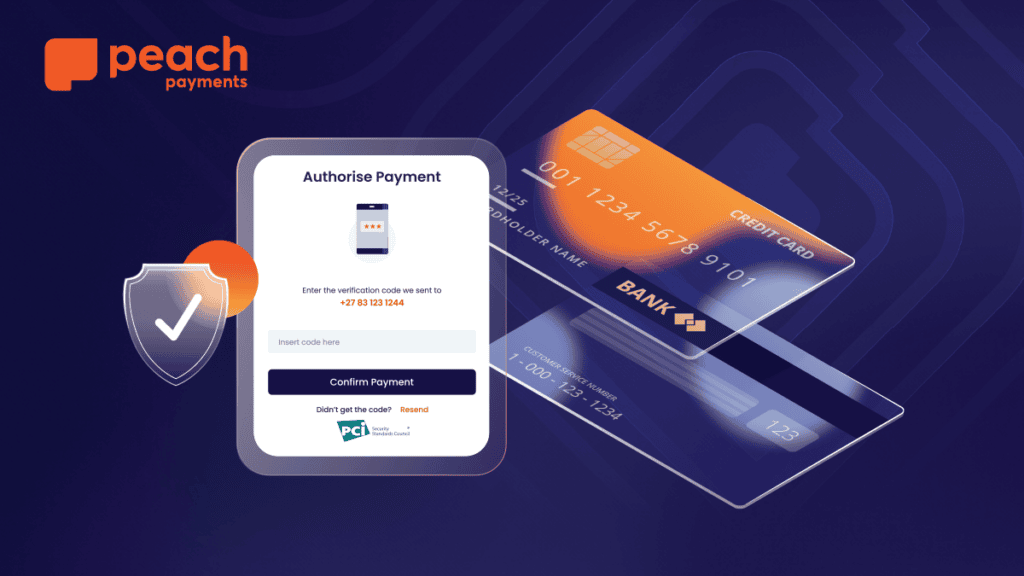

The foundation of any successful online business is trust, and a significant aspect of this trust revolves around the security of payment transactions. Studies show that at least a quarter of all card abandonments are due to the fact that customers don’t trust the security on your payment page. This statistic underscores the critical role security plays in not only protecting financial data, but also in maintaining customer trust and reducing cart abandonment rates.

Integration Methods and Their Security Implications

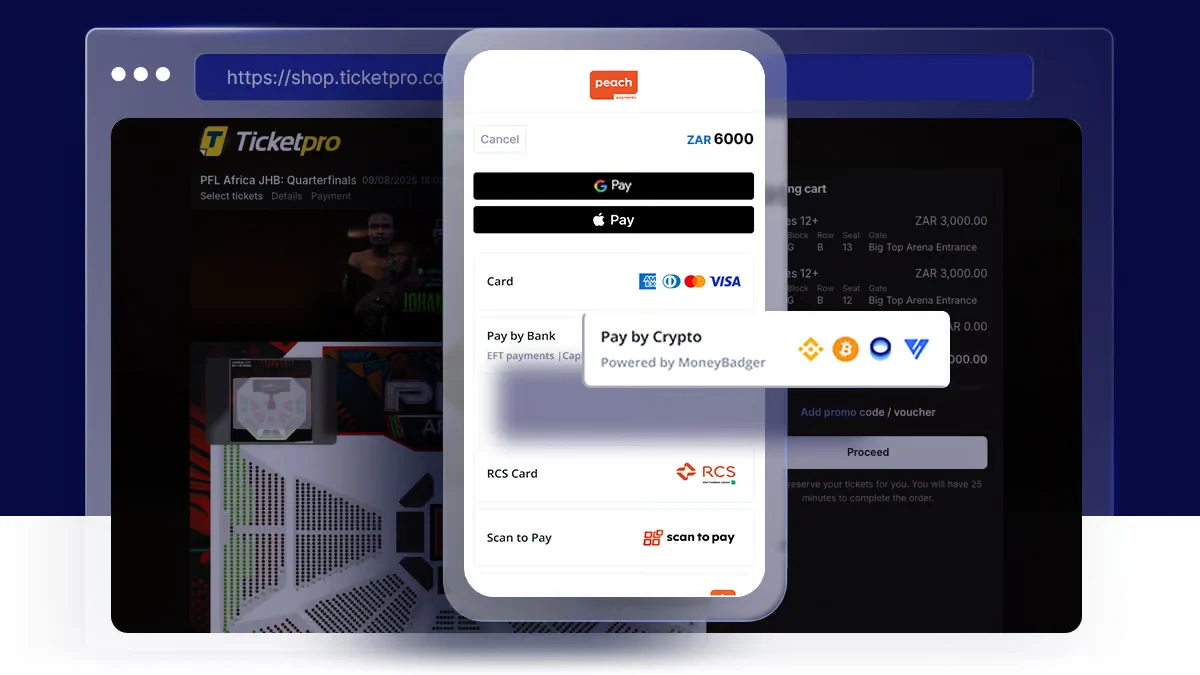

Peach Payments offers a variety of integration methods tailored to suit different business needs, each with its own set of security and compliance responsibilities.

Server-to-Server (API) Integration: This method provides merchants with the highest degree of control over their payment processes. However, it also places the majority of security and compliance responsibilities directly onto the merchant’s shoulders.

Hosted Checkout: Here, customers are fully redirected off the merchant’s site to Peach’s hosted checkout page. This method offers compliance benefits as the majority of the payment process occurs offsite, reducing the merchant’s burden.

Embedded Checkout: This elegant solution allows for a smoother customer experience by embedding a card capture widget directly on the e-commerce site, typically done through an iframe. However, with the rise of e-skimming attacks, even this method requires stringent security measures.

The Menace of E-Skimming

E-skimming, an attack on the rise, involves cybercriminals injecting malicious JavaScript into vulnerable websites to steal card data during the checkout process. A threat actor will inject something called malicious JavaScript onto a vulnerable website.This script can either scrape keystrokes as the data is entered or execute an iframe overlay attack, making it nearly impossible for users to distinguish between legitimate and malicious card capture forms.

PCI DSS Version 4: A Game Changer

In response to the growing threat of e-skimming, the Payment Card Industry (PCI) Council revised its Data Security Standard (DSS), introducing Version 4. This updated standard not only mandates the security of the payment form but also the entire website hosting it.

How Peach Payments is Pioneering Secure Solutions

Peach Payments has promptly implemented the new requirements from PCI DSS Version 4, easing the compliance burden on merchants. Their approach includes:

Continuous Monitoring: Peach consistently monitors merchant payment pages for any unauthorized code, preemptively stopping potential threats.

Alert Mechanisms: We have systems in place to alert admins to any form of tampering or scripting activities. These measures ensure a secure transaction environment, allowing businesses to focus on growth without worrying about security vulnerabilities.

The Future of Secure Payments

Peach Payments’ commitment goes beyond just compliance. By monitoring scripts and preventing iframe overlay attacks in real-time, Peach Payments allows businesses to stay one step ahead of cybercriminals.

Conclusion

In today’s digital economy, robust payment security is not optional; it is essential. With rising threats like e-skimming, businesses need reliable partners to navigate the complexities of online security. Peach Payments stands out by not only addressing current threats but also anticipating future challenges, making them an invaluable ally for any online business.