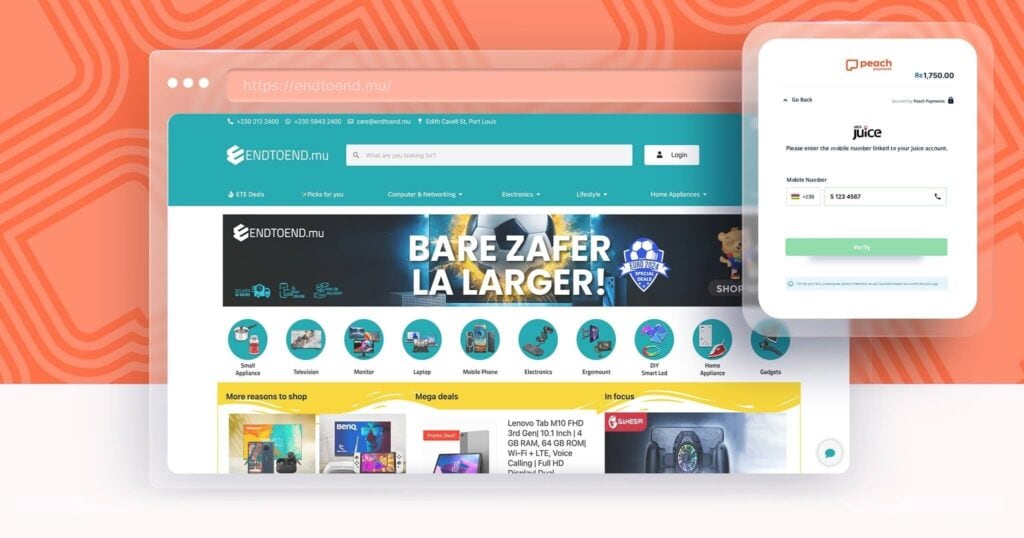

Endtoend.mu, a leading e-commerce platform in Mauritius, offers over 100 categories, including Tech, IT, Home Appliances, Powertools, Fitness, and Lifestyle products. Committed to delivering top-tier customer service with timely deliveries within 48 hours, Endtoend.mu attracts over 100,000 visitors each month.

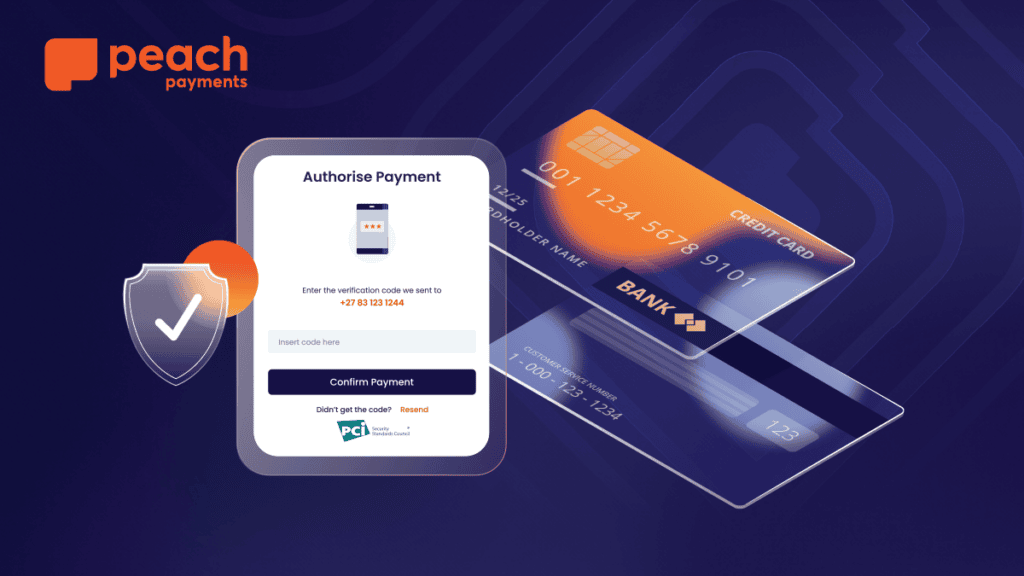

To enhance customer experience and trust, Endtoend.mu embraced digital payment methods, partnering with Peach Payments. This collaboration has streamlined the checkout process, boosted conversions and sales, optimized operations, and reduced the risk of fraudulent orders, significantly expanding their transaction capabilities and customer reach.

To scale even further, the company introduced MCB Juice through Peach Payments as an alternative payment method.

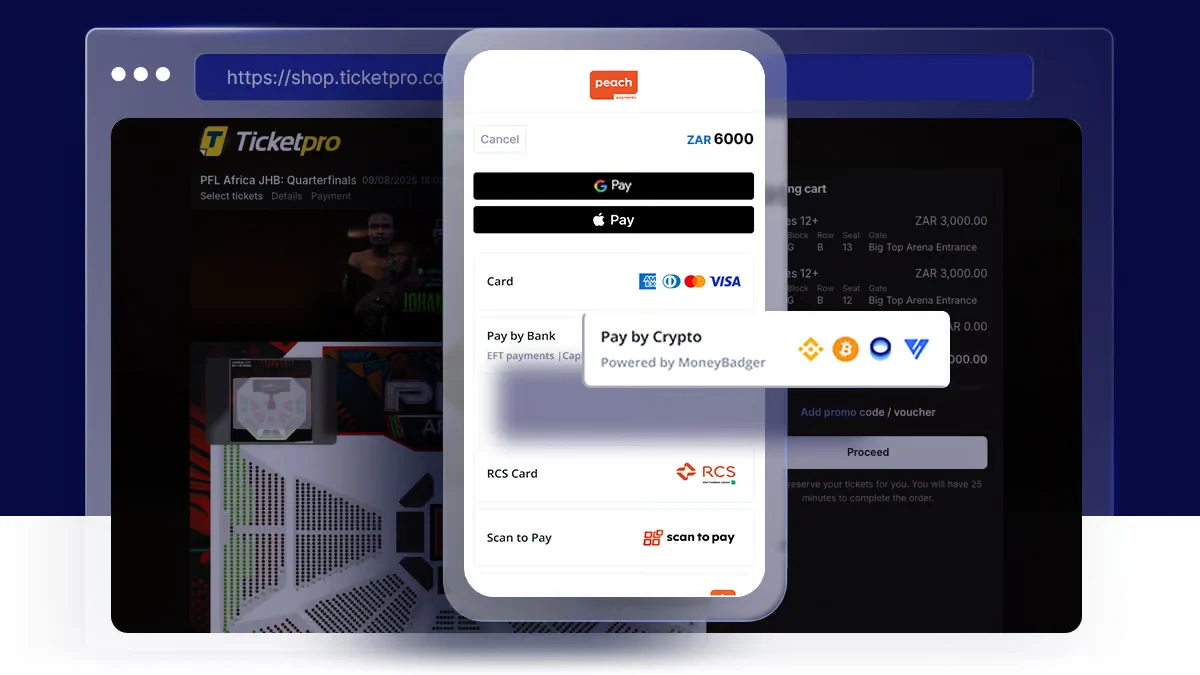

As a digital wallet, MCB Juice enables MCB customers to make purchases with just their contact number, bypassing the need to enter banking details for each transaction.

Why did you choose to add MCB Juice as an alternative payment method to your e-Commerce store?

Endtoend.mu was among the first e-commerce platforms in Mauritius to offer Pay-on-Delivery services, allowing payments by Cash, Card, and MCB Juice.

Despite the inherent risks, such as potential order cancellations and resource investment, the Peach Payments Gateway has been instrumental in mitigating these challenges.

Customers appreciate the convenience of making purchases from home and paying directly online, reinforcing Endtoend.mu’s credibility as a reliable e-commerce platform.

Additionally, the flexibility and convenience of MCB Juice are highly valued by customers, whether they shop online or at the physical outlet in Edith Cavell, Port Louis. This seamless payment experience aligns perfectly with Endtoend.mu’s philosophy of providing hassle-free service.

What benefits have you experienced since introducing MCB Juice to your customers?

To start, the security and convenience of MCB Juice have significantly boosted customer trust and satisfaction. Currently, over 53% of our customers choose MCB Juice for their transactions, and we expect this number to grow as the trend towards a cashless economy continues.

Secondly, MCB Juice has not only streamlined our checkout process, but also optimized our operations for transaction reconciliation with the Peach Payments dashboard. The instant transaction processing ensures swift order fulfillment, reinforcing our reputation for exceptional service and contributing to increased customer loyalty and repeat purchases.

And lastly, MCB Juice has been instrumental in helping Endtoend.mu expand our customer base and target a larger audience, making us more inclusive and accessible to shoppers from all corners of the country.

“Endtoend.mu’s partnership with Peach Payments and MCB has been pivotal in our journey towards becoming one of the most thriving e-commerce platforms in Mauritius” Reekesh Reetun – Founder / CEO – End to End

Do you have any advice for other e-commerce companies in Mauritius?

As an online business, aspired to become one of the most thriving e-commerces on the local market, embracing digital payment methods and expanding our payment options was an obvious choice to facilitate transactions and enhance customer experience and trust. Endtoend.mu’s partnership with Peach Payments and MCB has been pivotal in our journey towards becoming one of the most thriving e-commerce platforms in Mauritius.

We are grateful for the support and innovation that MCB Juice has brought to Endtoend.mu, and we look forward to continuing this successful partnership.

How does MCB Juice work?

- The customer will apply via the MCB Juice app

- When making a purchase on a merchant e-commerce site, the customer will insert their contact number – no need for banking details every time

- As an extra security measure, customer will authenticate the transaction using biometrics or a Mobile Pin on the MCB Juice app

To learn more, or apply for MCB Juice, click here.<\/p>