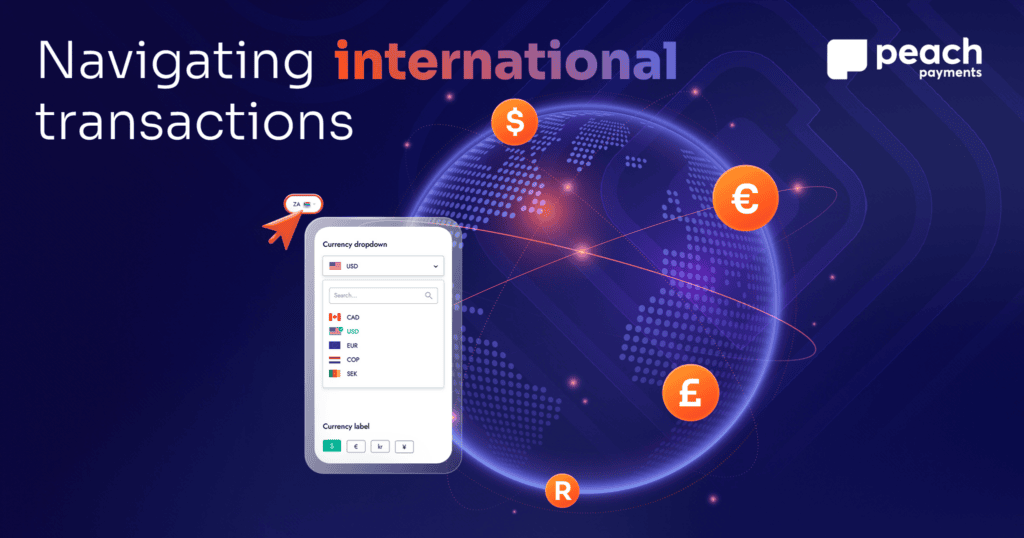

With the internet connecting the world like never before, many South African ecommerce businesses have begun to sell their products in international markets. But how exactly does payment work, and what are the options for local merchants?

Update: In September 2023, we held a webinar about multi-currency. You can view it here.

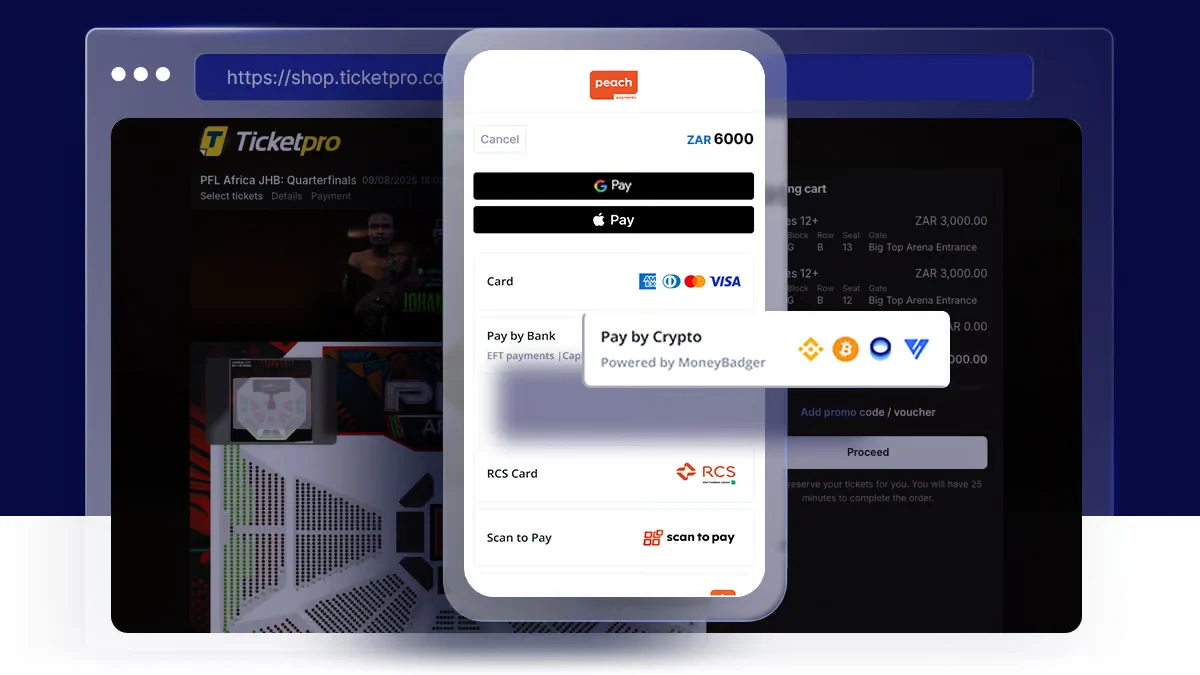

There are two main options for receiving international payments:

- Accept international payments and process in South African Rands (ZAR)

- Accept international payments and process those payments in the currency in which your customers usually pay (e.g. US Dollars or Pounds in the UK)

Importantly, in both of the above cases you can display prices in foreign currency. In the first instance, by using a currency converter plug-in on a website configured in ZAR, and in the second, by configuring your website in the base currency in which your customers transact. Bear in mind that customers may not be charged exactly what the currency converter displays, because the issuing bank still needs to apply whatever the current exchange rate is before charging the card.

With that out of the way, let’s look at each of the above cases in a bit more depth:

Accepting foreign cards and selling in ZAR

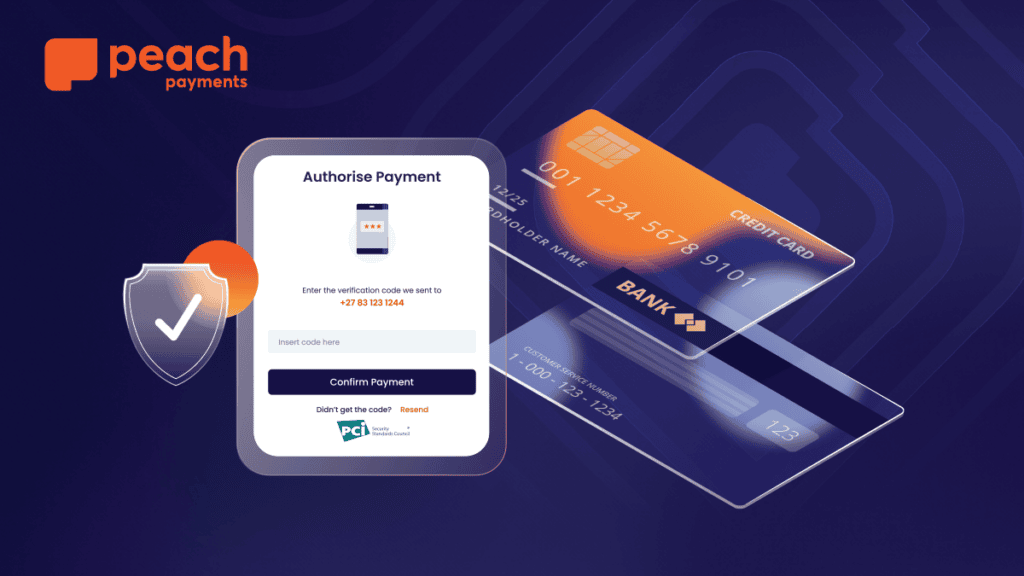

Off the bat, you will need to make sure your payment gateway is set up to accept foreign cards. Payment gateways will often block foreign cards as a matter of course, and in some cases, do not allow foreign cards to transact at all, due to worries about fraud. At Peach Payments, all our merchants can accept foreign cards (although there are sometimes exceptions based on the industry in which the merchant operates).

A couple of things to consider when going this route:

- Your customer is paying the forex conversion rates (if any). Your customer’s card issuing bank will apply a conversion rate and post the amount in the foreign currency to the customer’s card account

- Refunds may not result in the same amount paid back to your customer, as exchange rates may have changed in the interim and a different conversion rate is applied during the refund. Be sure to address this possibility with customers prior to refunding them to prevent dissatisfaction!

Multi-currency selling

In the case of multi-currency selling, you would price the product in the currency in which your customer will be paying, and your payment gateway would process the payment in that currency (i.e. there is no conversion rate applied to the amount during the transaction – although there will be when the acquiring bank or your payment gateway settles the transaction to your bank account).

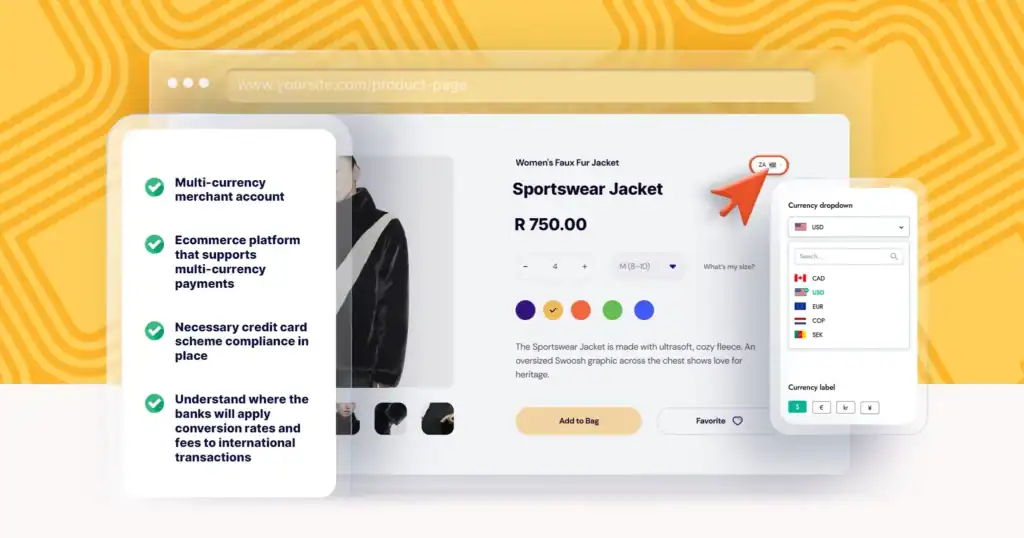

Key consideration with the multi-currency approach:

- You as the merchant need a multi-currency merchant account. At Peach Payments, we make use of the ABSA multi-currency account for merchants wanting to sell overseas.

- Card scheme location compliance means you need to prominently display the merchant country where the transaction will be processed on the checkout screen or the sequence of screens leading up to checkout.

- Not all ecommerce platforms support multi-currency options easily – WooCommerce, for example, allows you to configure your store in one currency only.

- Your customers will still see the transaction as a ‘foreign transaction’ as your business is based in a foreign currency, and so some issuing banks may still charge the customer a ‘foreign transaction fee’ even though you have priced the product in their home currency

- As mentioned, there will be a conversion rate applied by the bank when you are settled, and there is some margin applied here on the conversion for the bank. Important here is that you as the merchant carry the risk for currency volatility: if you sell when it’s 15 ZAR to the Dollar, and you need to refund a customer and it’s now 16 ZAR to the Dollar, you are going to have to pay in the extra money to refund the customer the Dollar amount that they paid.

A final international ecommerce consideration: fulfilment

For merchants selling services or digital products, fulfilment is less of a problem. But in the case of physical products, there are several areas about which you want to think:

- Logistics – how will you ship the product to the customer (and how will you account for those costs?)

- What condition will goods arrive in, and are customers likely to dispute the transaction because they aren’t satisfied?

- Are the products you’re selling in any restricted categories in the buyer’s country? This means lots of extra paperwork.

- Are there limits on the quantities your buyers can import?

- What are your return terms and conditions?

At Peach Payments we’ve been helping merchants sell internationally for over a decade. If you have any questions, feel free to get in touch with us.

UPDATE: We had a webinar in September, 2023 explaining how to start with Shopify and WooCommerce for multi-currency checkout. You can view it here.