We’re a payment gateway that strives to remove admin for our merchants and help them do more with their time. Recently, we released our new Payment Links product, which helps customers pay our merchants from anywhere. Now, we’re thrilled to announce two further updates to Payment Links: the bulk uploads and terms of service features.

Bulk Payment Link Uploads

Merchants can now simplify their workflows and improve their processes by utilising our bulk payment link upload feature. Simply upload a CSV containing the relevant details and send all your payment links at once.

- Merchants can create bulk links through the Dashboard or API using CSV files (the uploaded bulk file should have a maximum of 1000 rows)

- Payment links will be created based on data pulled from a filled row in the CSV file. There is a helpful sample CSV file in the dashboard that merchants can download and use

- Payments made through created batch links can be identified using the PAYMENT_BATCHLINKS custom parameter.

- Merchants using the API can see results of the batch send, including the state, how many rows were processed, and how many rows were successful.

- If a merchant uses the Dashboard, they will see the status of the batch in the Dashboard. If there are batch errors, details about those errors will appear in the Dashboard as well. Merchants can download the error files (rows.csv) and error details (details.txt) directly from the Dashboard.

For more information and a walkthrough on how to use the bulk uploads functionality, watch our Bulk Payment Links Video below:

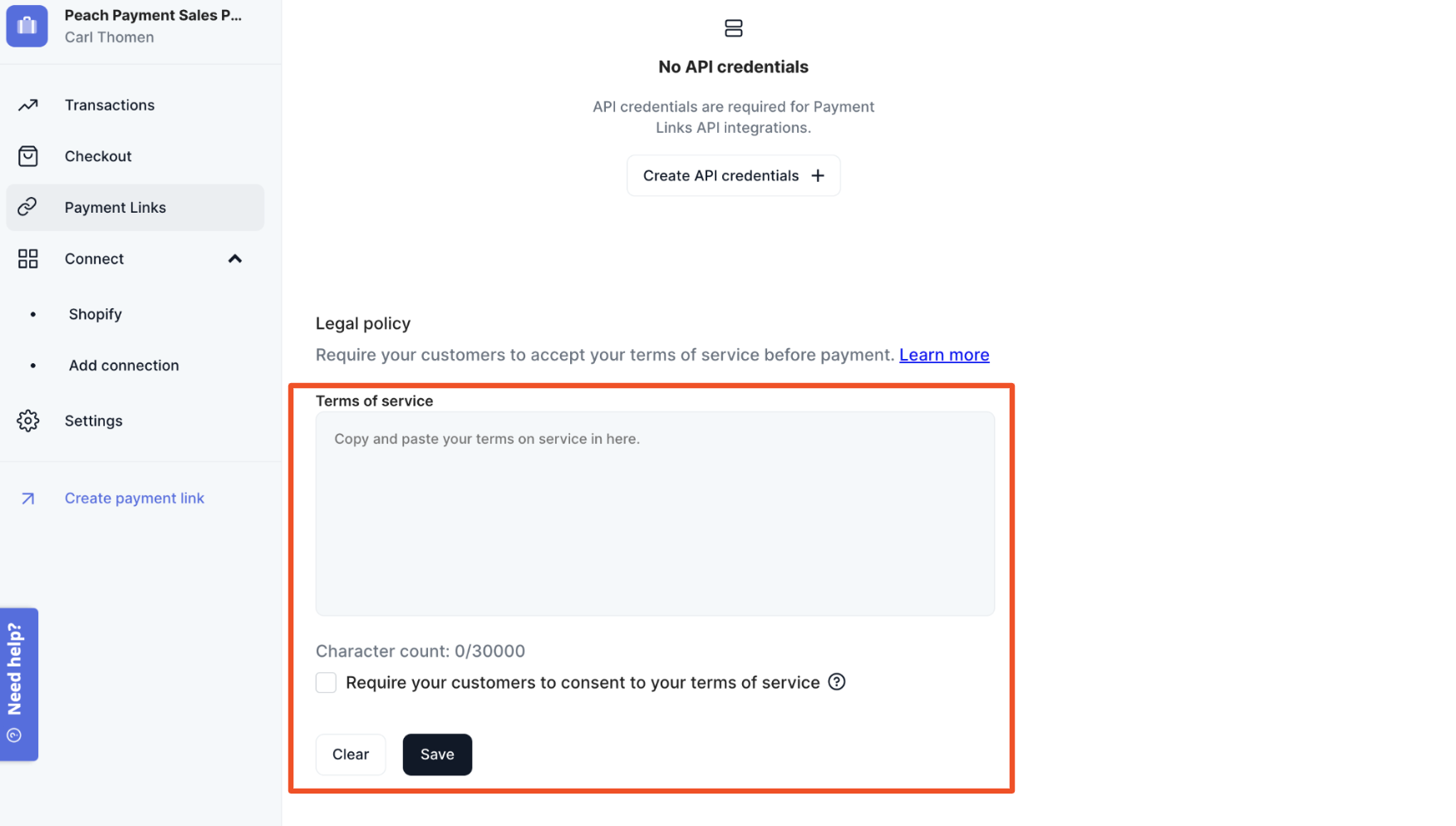

Terms of Service

Merchants using Payment Links can now also add their Terms of Service to the Dashboard under the Payment Links Settings page. This helps merchants ensure customers paying through Payment Links are aware of their Ts and Cs, both in general and also if customers have not encountered those Ts and Cs on the website or elsewhere.

This is important for a number of reasons:

- Legal and Compliance: Being able to add a legal policy to a payment link ensures merchants can comply with relevant laws and regulations, such as consumer protection laws, privacy laws, and anti-fraud regulations, if required.

- Transparency: A legal policy informs the customers about the terms and conditions of the transaction, including any fees, refund policies, and privacy policies. This transparency helps build trust with customers, which can ultimately lead to repeat business.

- Risk Management: Including a legal policy in a payment link can help mitigate the risk of disputes or chargebacks. By clearly outlining the terms and conditions of the transaction, there is less room for confusion or misunderstanding between the merchant and their customer.

- Liability Protection: A legal policy can also help protect the merchant from liability in the event of a legal dispute. By including a clear and comprehensive legal policy, merchants can demonstrate that they have taken steps to inform customers about their rights and obligations.

To add your Terms of Service to your payment links, simply click the Payment Links tabs in your dashboard and scroll down until you see the Terms of Service box near the bottom. You can then copy and paste your Terms of Service text into the box, and decide whether you want to require your customers to consent to them before making the transaction.