Stats SA’s Q1 2023 Quarterly Labour Force Survey showed that almost 250,000 young people lost their jobs in that quarter. This means that a total of 4.9 million young South Africans are unemployed.

If you are one of them, starting a business from home is a great way to earn money, boost your confidence and develop skills. With South African consumers increasingly moving to online shopping – from 27% in 2020 to 38% in 2022 – an online startup may just be your best bet.

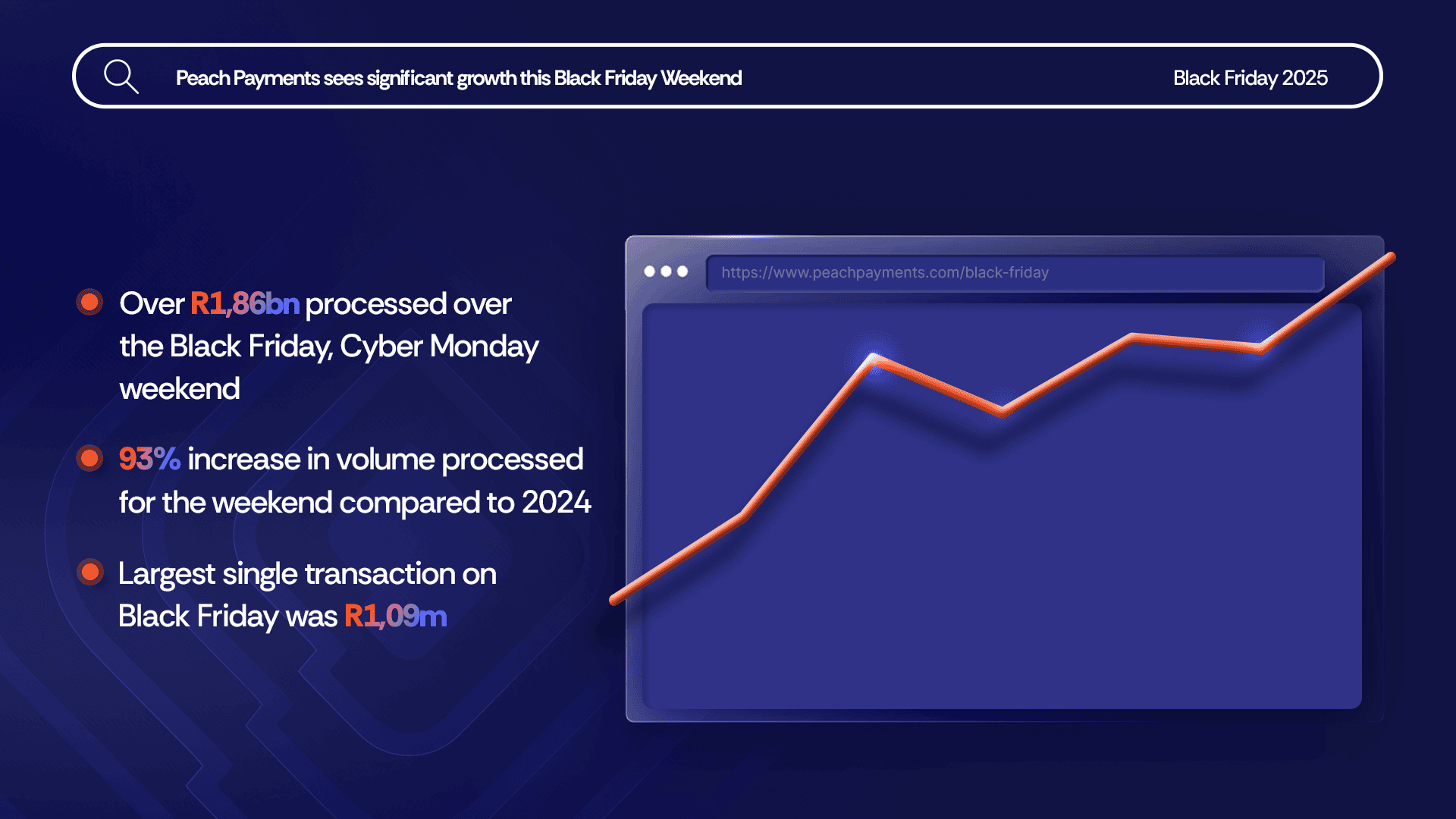

Says Joshua Shimkin, Head of SME Growth & Marketing at Peach Payments, “If you set up your business ahead of Black Friday and Cyber Monday, you’ll be ready to cash in on this lucrative shopping event. You’ll tap into the heightened consumer demand and benefit from the increased traffic and sales opportunities.”

Launching your online business a few months before the Black Friday shopping weekend will let you test your systems, processes, and customer experience. You can then use these insights to identify and address any issues or bottlenecks, and ensure that your operations are streamlined and optimised.

“It can be challenging to start an online business without funding, but with the right approach and dedication, it’s possible to build a successful venture,” says Dirk Tolken, co-founder & CMO at Semantica Digital, a specialist e-commerce and digital marketing agency.

Here’s what you need to get you started:

- A profitable niche: Competitor research is essential when starting an online business. There’s no point in trying to compete with the big players if you’re not going to be able to offer something unique. Use free tools such as Google Alerts, and search on social media platforms and online communities to gather information about your competitors. Analyse publicly available information in press releases, websites, and social media accounts to understand their offerings, pricing, target audience, and customer feedback. Focus on actionable insights that can inform your strategy and differentiate your startup. This approach will also tell you whether shoppers are interested in buying the product you intend selling, be it clothing, holiday tours or beauty treatments.

- A solid business plan: To develop a business plan, first conduct market research, identify your target audience, and decide on a marketing and sales strategy. Think of a well-crafted business plan as a blueprint for you to run and grow your startup effectively. There are some good examples here.

- Start lean: Work from home to minimise overhead costs, use the resources you have already, and spend money on only the essential tools and services you need to run your business. Prioritise tasks that directly impact revenue generation, like effective marketing and sales strategies, getting and keeping customers, optimising pricing, and forging strategic partnerships. Take advantage of online tutorials, webinars, and resources to develop your skills and knowledge.

- A website: A website is the foundation of your online presence. It is a central hub where potential customers and partners can learn about your startup, its products or services, and its value proposition. Through your website, you can generate leads, make sales, and build your brand. It’s a powerful tool for growth, visibility, and success in the digital era. If you’re a novice, use a website builder like Wix or Shopify to create your site.

- Optimised images: For websites to display correctly on any device, you’ll need optimised open graph images and site icons (images that show up in the right shape, size and format irrespective of the device that is used to access your website). Don’t make the mistake of thinking of them as an unnecessary time-sink or expense. They influence the performance of the content links you share on Facebook, LinkedIn, Pinterest and Twitter and create a professional look. Most website builders have a functionality to optimise images – look for it or ask for help in online forums dedicated to your website builder. There’s a useful summary of what needs to be done here.

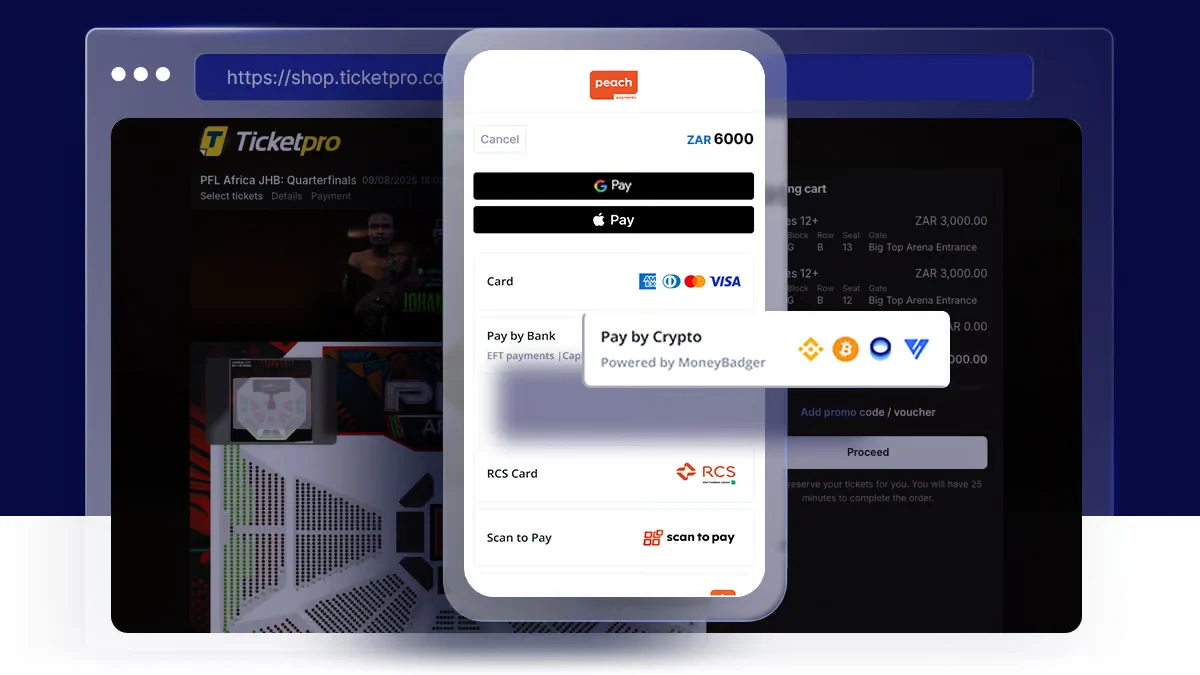

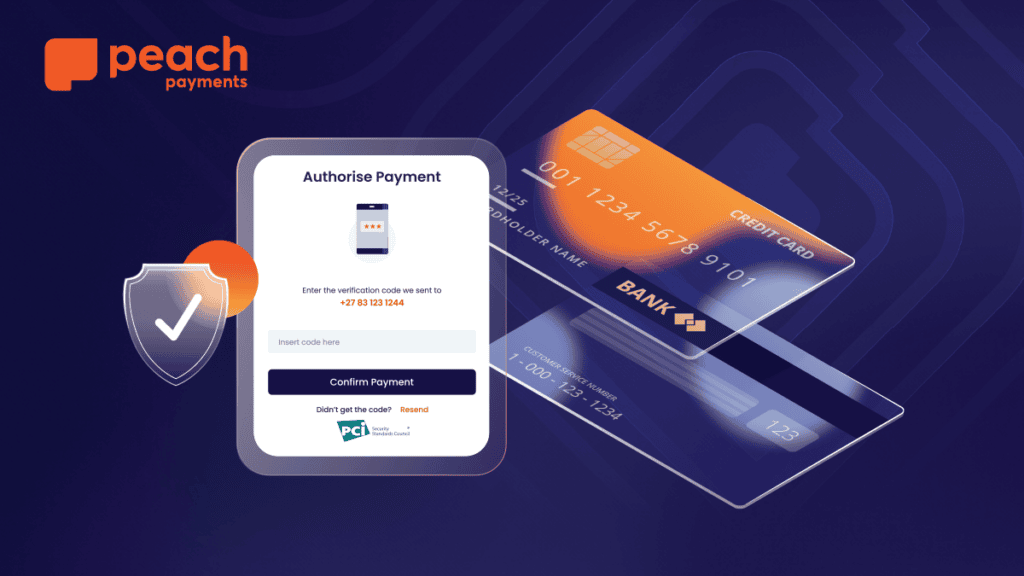

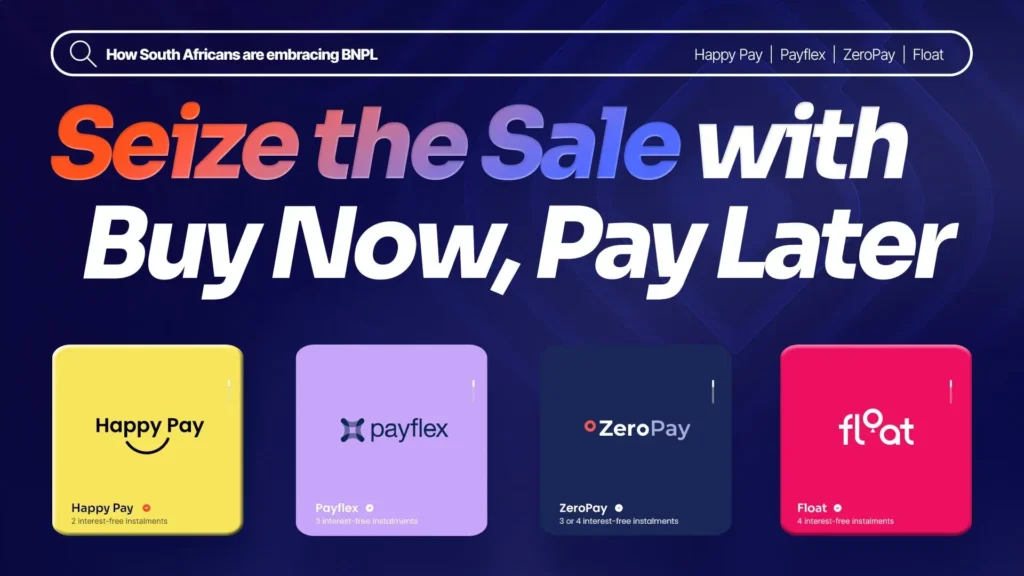

- Accepting payments: Secure and reliable payment methods build trust and credibility with your customers. To maximise sales opportunities, you need a comprehensive payment platform that accepts different forms of payment (credit and debit cards, buy now pay later options and vouchers, among others). Being able to pay effortlessly will improve customer satisfaction, and drive the success of your business. Check on your website builder’s site for a list of payment platforms that integrate with your website. Then investigate their functionality and costs to choose the best option for your business. Pro tip: Some payment platforms will complete administrative tasks like invoicing, issuing receipts, and bank reconciliations, which can come in handy if you’re a solopreneur.

- Email marketing: Email marketing is a great way to build customer loyalty and increase sales. It allows you to engage with your audience, and offer exclusive discounts. If you don’t have a way to capture your customers’ email addresses, you’re missing out on a huge opportunity. Klaviyo, Mailchimp and HubSpot are among the top email marketing tools available. MailBlaze is a local option.

- Social media marketing: Social media platforms like Facebook, Instagram, Pinterest, Threads and X (previously called Twitter) will help you to promote your business and engage with potential customers. To ensure ongoing success, analyse and improve your marketing efforts where necessary. Stay adaptable, experiment with different tactics, and evaluate and adjust your strategies as needed. A simple tool to get you started is Friends+Me. Buffer and Hootsuite are popular and have reliable free versions.

“There’s no stopping consumers from taking advantage of Black Friday deals,” says Tolken. “In 2022, FNB customers alone made purchases worth over R3 billion on Black Friday. Gearing up your online business in time is a smart way to boost your earnings.”

Shimkin agrees. “Starting a new venture is hard work, and it will take time to grow,” he says, “but if you stay committed to your goals and consistently deliver value, you can expect success beyond the biggest shopping weekend.”.<\/p>