With ecommerce adoption accelerated by three- to five years as a result of the Covid-19 pandemic, and online retail in South Africa in 2020 growing by 66%, it is perhaps understandable that small to medium enterprises (SMEs) have found themselves online out of necessity.

To help entrepreneurs who want to iron out the creases in their online presence, Peach Payments’ Head of SME Growth and Marketing, Joshua Shimkin, highlights six mistakes SMEs tend to make online, and how to solve them.

- 1. Social media profiles, but no website

Social media is an easy way for many SMEs to get in touch with their customers, and sell to them. Most social media platforms – including Facebook, Instagram, TikTok and Pinterest – also offer some way of accepting payments.

“But if there is no website that customers can refer to when they’re looking for your business, they’re just as likely to buy from your competitor’s Instagram profile, which has an accompanying website to support their online presence, where they can see shipping policies and refund/return policies. Customers are still more used to finding those key signals of trust on websites,” Shimkin warns.

Instead, spend time putting together a basic website on Wix, WordPress or Shopify, and then link to it from all your company’s social media profiles.

- 2. All the socials – and all outdated

“Don’t think it’s essential to be on every single social media platform out there,” Shimkin says. He believes it is much more important to have one or two active and fun social media profiles than to have outdated and boring content associated with your business spread across ten different social media platforms.

“Choose the social media platforms you focus on based on what you know about each platform’s users,” he advises.

For instance, if you have gorgeous pics of the homemade food you deliver, Instagram and Pinterest are likely to be more useful for your business than a more staid LinkedIn post. Add a quick video and you also have content for TikTok and Instagram. Remember to include links to your profiles on your website, and deactivate all old profiles on social media platforms you decide don’t work for your business.

“That way people won’t see old content, and wonder if you’re still in business,” Shimkin says.

- 3. An outdated and clunky website

Once your website is up, it’s important to keep it updated with new blog posts, new products, and updated payments technology. This is what will make people come back, looking for your products and services.

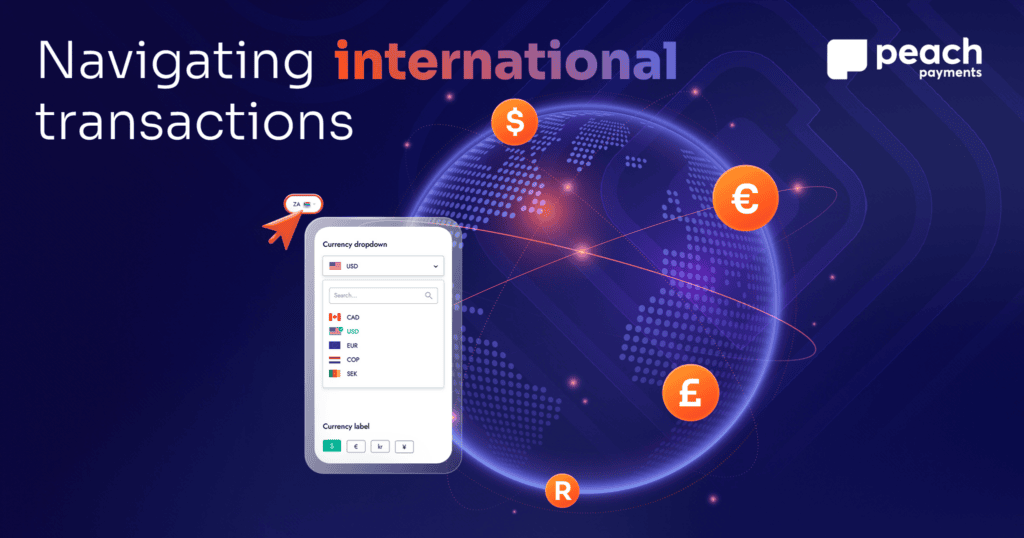

Use the free templates in popular website builders like Wix, WordPress or Shopify to ensure your website is mobile-friendly because it’s non-negotiable in 2022. And it is particularly important in Africa, where mobile is the most popular way for people to access ecommerce.

“You don’t necessarily need to spend money on developing an app, but you do need to make sure your website is easy to read on a mobile screen,” Shimkin advises.

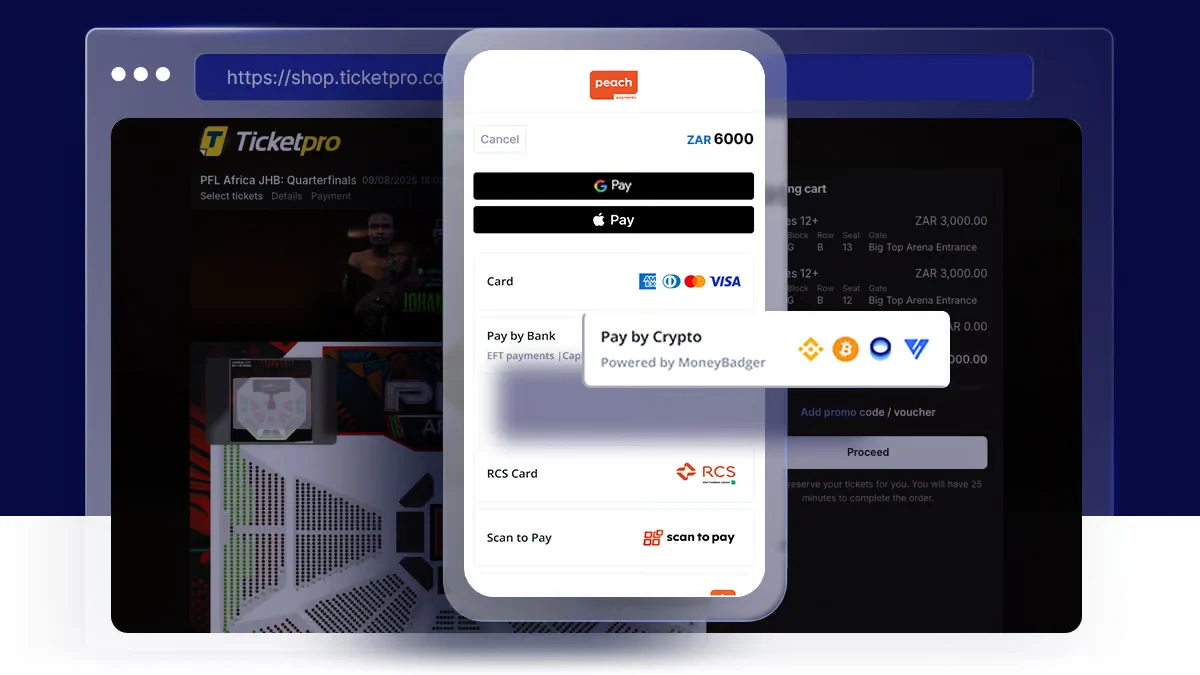

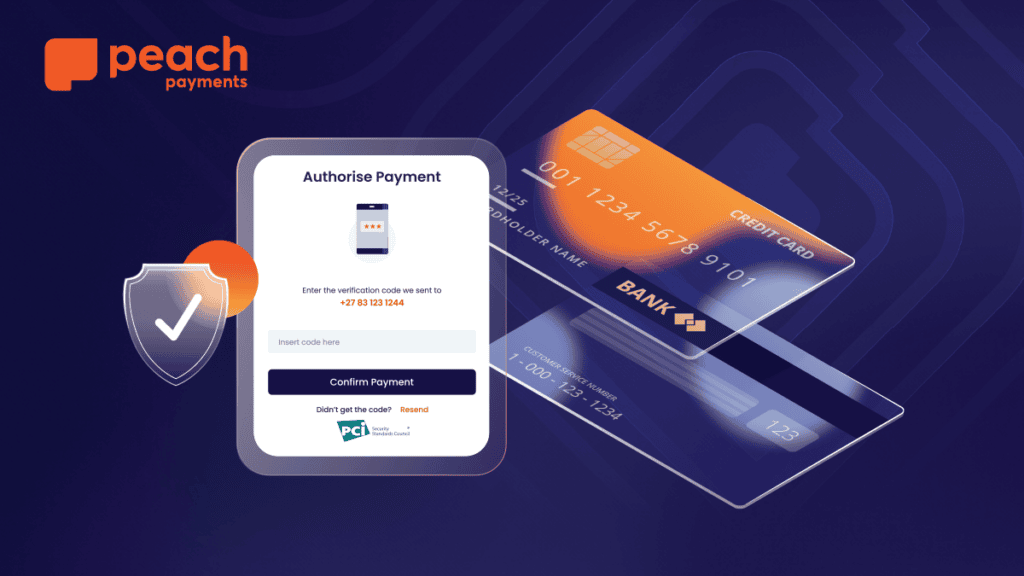

Also make sure you have an easy, reassuring checkout process with multiple payment options (credit and debit cards, QR codes and instant EFTs) so that customers have a number of ways to pay securely.

- 4. Ignoring local SEO

You may not be interested in landing on the first page of global search engines, but you should make sure that your business website hits the first page on any “near me” searches on Google,” Shimkin says.

This local search engine optimisation (SEO) can make or break your bricks-and-mortar business, particularly if your business is the type that only services your local neighbourhood or city, and not the whole country – like a local restaurant that offers online ordering. It is also important if you’re an online business that isn’t yet ready to start shipping internationally.

Two of the easiest ways to improve your local SEO results are to embed a Google Map in your Contact Us page and to verify your Google My Business page. Also include these details on all your social media profiles as well, so your website becomes the hub for all your marketing activities, such as newsletters and special offers.

- 5. Not remarketing to your online customers

Take time to learn about and use the remarketing tools that come with all e-commerce website builders to your advantage. They will help you to better understand who your online customers are, where they’re based and how many people come to your website but don’t buy anything. It will also give you insight into how long they spend on your site, where they are getting stuck on your site, and which type of device (mobile or desktop) they are using – all useful to help you tailor your offering.

Google Analytics is a free and powerful tool to help you understand who your clients are – and not just who you dream or hope they are. That will help you serve their needs better. Shopify, Wix and WordPress all have easy integrations that incorporate Google Analytics seamlessly.

- 6. Be meticulous about checking your online pricing

Online mistakes can cost you – but none more than making a blunder like uploading a new product and leaving its pricing at R0 or R10 000, when it should be R100! This is something that happens surprisingly often and can be prevented with a quick double-check before making any product live.

“It may seem daunting, but it is pretty easy to fix minor mistakes that you may have made while rushing to get online. The difference it will make to your online business is likely to show very quickly,” Shimkin concludes.